Effective Crypto Trading Strategies for Profiting in Volatile Markets. Discover effective crypto trading strategies to boost your profits in volatile markets. Learn simple tips that anyone can use for success!

<<<<< Buy Now from Official offer >>>>>

Significance of Following Effective Crypto Trading Strategies

Investing in cryptocurrencies can yield high returns. Be that as it may, volatility challenges even expert traders. Effective crypto trading strategies help mitigate risks. By following a structured plan, traders can enhance their chances of profiting. Strategies guide traders on when to buy or sell assets. They provide a framework for decision-making.

In my experience, I’ve found effective strategies minimize stress & maximize profits. Consistently applying them sharpened my trading skills. Focusing on strategy rather than emotions made my trades more successful. Recognizing the importance of a strategy is crucial for long-term success.

Identifying Market Trends in Cryptocurrency Trading

Identifying market trends is crucial for successful trading. It helps traders make informed moves. There are several methods to spot trends, including technical analysis & fundamental analysis.

Technical analysis involves studying price charts & indicators. Tools like Moving Averages, RSI, & Bollinger Bands assist traders. These indicators reveal price action & market momentum. Fundamental analysis considers news & events affecting the market. Major announcements can shift prices rapidly.

| Trend Indicator | Description |

|---|---|

| Moving Averages | Smooth out price data over specific periods. |

| RSI (Relative Strength Index) | Measures the speed of price changes. |

| Bollinger Bands | Indicate volatility & price levels. |

Utilizing both analyses can yield better results. Traders should combine technical insights with news developments. This comprehensive approach can lead to higher profits in volatile markets.

Risk Management Techniques in Crypto Trading

Effective risk management is vital for any trader. Volatile markets can lead to losses if not handled properly. There are several risk management techniques to employ.

- Set Stop-Loss Orders: Automatically sell when prices drop to a certain point.

- Use Position Sizing: Determine how much to invest based on account size.

- Diversify Your Portfolio: Spread investments across different cryptocurrencies.

- Regularly Review Trades: Assess winning & losing trades for improvements.

Stop-loss orders safeguard investments. They prevent emotional trading decisions. Position sizing ensures no single trade can destroy the account. Diversification minimizes risk by not relying on one asset. Reviewing trades provides insights for future trading decisions. Effective risk management leads to long-term success.

Implementing Swing Trading Strategies for Short-Term Profits

Swing trading is a popular strategy for capturing short-term profits. This approach involves holding cryptocurrencies for days or weeks. Traders aim to profit from price fluctuations.

To implement swing trading effectively, technical analysis is key. Traders identify support & resistance levels. These levels help determine entry & exit points. And another thing, utilizing indicators like MACD can assist in decision-making. Timing trades perfectly is crucial for profits.

| Indicator | Purpose |

|---|---|

| MACD | Tracks momentum changes in price. |

| Fibonacci Retracement | Highlights potential reversal levels. |

Traders should set clear profit targets. Emotion can cloud judgment during trades. Having a defined plan reduces emotional strain. Swing trading can yield profits in volatile markets if executed properly.

Scalping: Quick Profits in Flash Trades

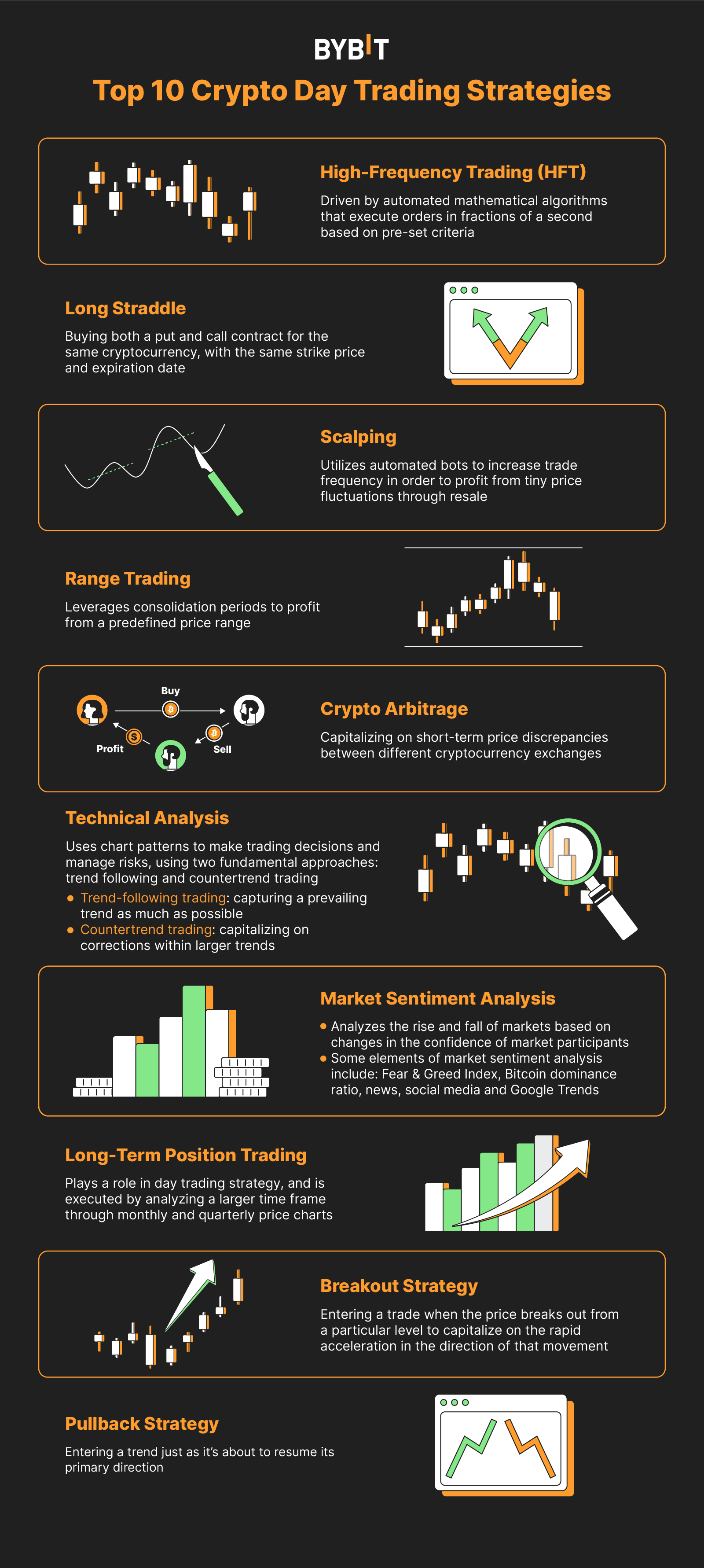

Scalping is a trading strategy focused on small price changes. Traders make quick trades, holding positions for minutes. This method requires precise execution.

Successful scalping relies on high liquidity coins. The main objective is to capture small profits multiple times. High-frequency trading platforms assist scalpers greatly. They provide tools necessary for quickly entering & exiting trades.

- Choose High Liquidity Coins: Focus on assets with significant trading volumes.

- Use Limit Orders: Control entry & exit prices effectively.

- Monitor Charts: Constantly analyze price movements for optimal trading.

Scalping can be exhausting. It demands continuous attention & quick decision-making. Be that as it may, with practice, it can lead to substantial profits, even in volatile markets.

Embracing Fundamental Analysis for Long-Term Gains

While technical strategies focus on price action, fundamental analysis considers the underlying value. This approach is crucial for long-term traders. Effective crypto trading strategies should include fundamentals.

Stay informed about the latest news regarding cryptocurrencies. Regulatory changes, technological advancements, & market sentiment can impact prices. Fundamental analysis helps traders identify promising projects & trends.

| Factor | Impact on Price |

|---|---|

| News Announcements | Positive news can lead to price surges. |

| Partnerships | New partnerships can increase a project’s credibility. |

| Market Sentiment | Investor sentiment significantly impacts prices. |

Combining both technical & fundamental approaches enhances trading success. Long-term gains often stem from understanding market fundamentals. Goals should reflect both short & long-term perspectives.

The Role of Emotion in Trading Decisions

Emotion plays a significant role in trading. Decisions based on fear or greed often lead to losses. Maintaining emotional discipline is crucial for a successful trading career.

Traders should develop a trading plan before entering positions. This plan includes entry & exit points. Sticking to the plan reduces the influence of emotions. Consider setting daily profit & loss limits. This practice prevents emotional decision-making.

- Develop a Clear Trading Plan: Outline all aspects of your trades.

- Set Daily Limits: Determine maximum losses & profits.

- Practice Patience: Wait for confirmation before making trades.

“The key is to trade with your head, not your heart.” – Angela McDonald

Staying focused on strategy rather than emotions leads to better outcomes. Trading requires a disciplined mindset for success. Over time, emotional control significantly enhances profitability.

Keeping Updated with Latest Trends & News in Crypto

Keeping updated on trends is essential for traders. Sentiment shifts rapidly in crypto markets. Changes can arise from news, social media, or market data.

Following reliable sources & news platforms aids in staying updated. Major events like software updates or regulatory decisions can affect prices greatly. Traders should also interact in online communities, like forums or social media groups. Engaging with other traders provides invaluable insights.

- Use News Aggregators: Collect cryptocurrency news from various sources.

- Follow Influencers: Identify trusted voices in the crypto space.

- Participate in Forums: Engage in discussions for diverse perspectives.

Information overload may occur, so focus on key updates. Having a reliable news feed streamlines the process. Timely information can provide crucial trading advantages.

Utilizing Automated Trading Bots for Strategic Execution

Automated trading bots become increasingly popular in crypto trading. These bots execute trades automatically based on preset criteria. Traders benefit from speed & efficiency.

Traders can set specific parameters for buying or selling assets. Bots can analyze market data quickly. They make trades based on rules without emotional influence.

SpeedExecute trades faster than humanly possible.

| Bot Feature | Benefit |

|---|---|

| 24/7 Trading | Allows trading at all hours without rest. |

| Backtesting | Evaluate strategies against historical data. |

While using bots, having a solid strategy is still essential. Bots cannot replace sound judgment. They aid traders when utilized correctly. Automated trading may result in higher profits in volatile markets.

Understanding Market Sentiments Through Social Media

Social media is a potent tool for gauging market sentiment. Traders look to platforms like Twitter, Reddit, & Telegram for insights. Breaking news spreads rapidly through these channels.

Monitoring social media can highlight emerging trends. Traders can react quickly to changes in investor mood. Using sentiment analysis tools enhances this process. These tools assess public opinion through social media metrics.

- Track Popular Hashtags: Identify trending topics in the crypto community.

- Join Relevant Groups: Engage with others sharing market insights.

- Utilize Sentiment Analysis Tools: Measure public sentiment towards assets.

Understanding sentiment allows traders to time their entries & exits better. Market mood can drive price volatility greatly. Being aware helps traders stay one step ahead.

Developing a Personal Trading Style

Every trader has a unique style. Defining your trading style can improve consistency. Factors influencing your style include risk tolerance & time commitment.

Some traders prefer short-term strategies. Others may adopt long-term investment approaches. Define what suits your lifestyle & goals best.

Experimenting with different strategies can refine your style. Keep a trading journal to track progress. Recording trades allows for reflection & adaptation. Over time, you’ll discover what works effectively for you.

- Assess Risk Tolerance: Understand how much risk you are comfortable with.

- Determine Time Commitment: Decide how much time you can dedicate.

- Experiment & Reflect: Continuously improve your techniques based on experience.

Creating a personalized approach leads to more meaningful outcomes. Authenticity in trading style enhances enjoyment & success.

The Future of Crypto Trading

As cryptocurrency evolves, trading strategies will also progress. New technologies & regulations will shape the landscape. Adaptability remains crucial for successful trading.

Innovations such as AI & machine learning will influence trading approaches. These technologies can lead to better analysis & predictions. Understanding these advancements is vital for forward-thinking traders.

Upcoming trends can create new trading opportunities. Keeping informed about changes in the crypto sphere ensures you’re ready. The future holds many possibilities for traders willing to adapt.

<<<<< Buy Now from Official offer >>>>>

Feature of Fox Signals

Fox Signals offers a comprehensive trading solution with a wide array of features tailored to meet traders’ needs. Here is a detailed description of its features:

- Lifetime Access: Users get lifetime access to Fox Signals, ensuring continuous usage without recurring fees.

- 60-Day Redemption: Code(s) must be redeemed within 60 days of purchase, ensuring timely activation of benefits.

- Future Updates: All future updates for the Lifetime Plan are included, keeping the product current & useful.

- Non-Stackable: This deal is non-stackable, meaning only one plan can be redeemed per user for clarity & simplicity.

Challenges of Fox Signals

Users of Fox Signals may face several challenges while utilizing this tool. Common issues often include the following:

- Feature Limitations: Users have reported that some advanced features might be lacking, which may hinder more experienced traders looking for deep insights.

- Compatibility Issues: Certain platforms or devices may not fully support Fox Signals, leading to accessibility challenges.

- Learning Curve: New users may find the interface & features complex at first, requiring time to fully grasp the functionality.

User feedback highlights several of these challenges, noting that additional tutorials or customer support could help mitigate issues. It may be beneficial to generate more user-friendly documentation or offer webinars that simplify the learning process for newcomers.

Price of Fox Signals

The pricing for Fox Signals is simple & straightforward. Here’s a detailed price breakdown:

| Plan | Price | Features Included |

|---|---|---|

| Lifetime Plan | $69 | Access to all features, updates, & support |

Limitations of Fox Signals

While Fox Signals is a valuable tool, understanding its limitations is crucial for users. Several potential shortcomings include:

- Missing Features: Compared to competitors, some users find Fox Signals lacks certain advanced analytical tools.

- User Experience Challenges: Navigating through the interface may not be as intuitive as with other platforms, creating barriers for efficient use.

- Customizability Issues: Users may prefer more customization options to tailor the tool to individual trading styles, which could be an area of improvement.

Case Studies

Real-life examples provide insights into how Fox Signals can work effectively. Below are a few notable case studies:

- User A: A novice trader utilized Fox Signals for less than a month, reporting profits from well-timed trades recommended by the platform. They overcame initial learning hurdles by following introductory guides.

- User B: An experienced trader integrated Fox Signals to enhance their strategies. They appreciated the timely alerts for entry & exit points, allowing them to maximize their trades effectively.

- User C: A user faced early challenges due to functionality issues. After reaching out for support, they received guidance on best practices that improved their overall experience significantly.

Recommendations for Fox Signals

Maximizing the benefits of Fox Signals can significantly enhance the trading experience. Here are some actionable recommendations:

- Utilize Tutorials: Make use of available tutorials to better understand features & maximize effectiveness.

- Engage with Community: Join forums or online communities where users share tips, strategies, & experience with Fox Signals.

- Implement Additional Tools: Consider integrating other analytical tools that complement Fox Signals, providing a more comprehensive trading strategy.

- Follow Market Trends: Stay informed on market developments & trends to make educated decisions when using signals.

- Regular Feedback: Provide feedback to the team for improvements, helping enhance user experience based on collective input.

What are some effective crypto trading strategies for profiting in volatile markets?

Some effective crypto trading strategies include day trading, swing trading, & using stop-loss orders. These techniques can help traders take advantage of price fluctuations & manage risk effectively.

How can I manage risk in crypto trading?

Risk management in crypto trading can be approached by setting stop-loss orders, diversifying your portfolio, & not investing more than you can afford to lose. Being aware of market trends also helps in mitigating risks.

Is it better to trade or hold cryptocurrencies during market volatility?

Whether to trade or hold depends on your investment strategy. Active traders may capitalize on short-term movements, while long-term holders may benefit from overall market growth, despite short-term fluctuations.

What tools can I use for successful crypto trading?

Traders can use various tools such as charting software, trading bots, & market indicators to analyze price movements & automate trades, enhancing their ability to profit amidst volatility.

How does using leverage impact crypto trading?

Using leverage can amplify profits in crypto trading, but it also increases the potential for losses. It’s crucial to understand how margin trading works & apply caution to avoid significant drawbacks.

What role do news events play in crypto market volatility?

News events can significantly impact crypto prices. Announcements regarding regulations, technological advancements, or market sentiment can lead to short-term price swings, making it essential to stay informed.

Why is technical analysis important in volatile markets?

Technical analysis helps traders identify patterns & make predictions based on historical price data. In volatile markets, this approach gives insights into potential price movements, aiding decision-making in trades.

Can psychology affect crypto trading success?

Yes, trader psychology plays a crucial role in crypto trading success. Emotional decision-making can lead to poor trades. Maintaining discipline & sticking to a strategy is essential for consistent profitability.

What is the importance of liquidity in crypto trading?

Liquidity is vital as it affects the ease with which you can enter or exit positions. High liquidity typically leads to tighter spreads & less price slippage, which is important in volatile markets.

Are there specific patterns to watch in crypto trading?

Yes, certain patterns like head & shoulders, double tops, & triangles can indicate potential price movements. Recognizing these can enhance trading strategies in volatile conditions.

How often should I review my trading strategies?

Regularly reviewing your trading strategies is essential, especially in volatile markets. Analyzing performance & adjusting strategies based on recent data can lead to improved outcomes over time.

<<<<< Buy Now from Official offer >>>>>

Conclusion

In the world of crypto trading, having effective strategies is essential to help you thrive in volatile markets. By sticking to these crypto trading strategies, you can maximize your chances of turning a profit. Always keep an eye on market trends, set clear limits, & never let emotions drive your decisions. Diversifying your investments & practicing patience can also lead to better outcomes. Remember, it’s all about finding what works for you & staying informed. With the right approach, you can navigate these ups & downs & make the most of your crypto trading journey. Happy trading!

<<<<< Buy Now from Official offer >>>>>