Cryptocurrency Market Trends: Key Insights & Future Predictions. Discover the latest Cryptocurrency Market Trends & gain key insights! Explore future predictions that can help you navigate the exciting crypto landscape.

<<<<< Buy Now from Official offer >>>>>

Current State of the Cryptocurrency Market

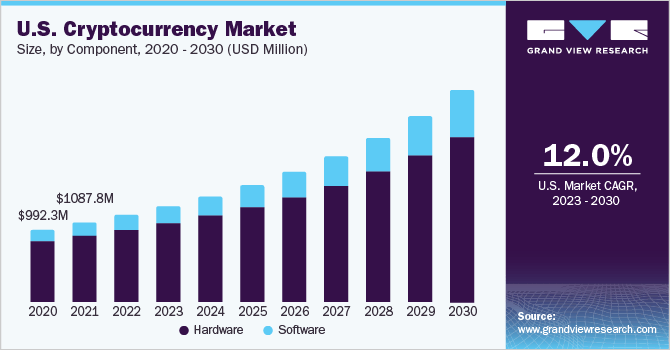

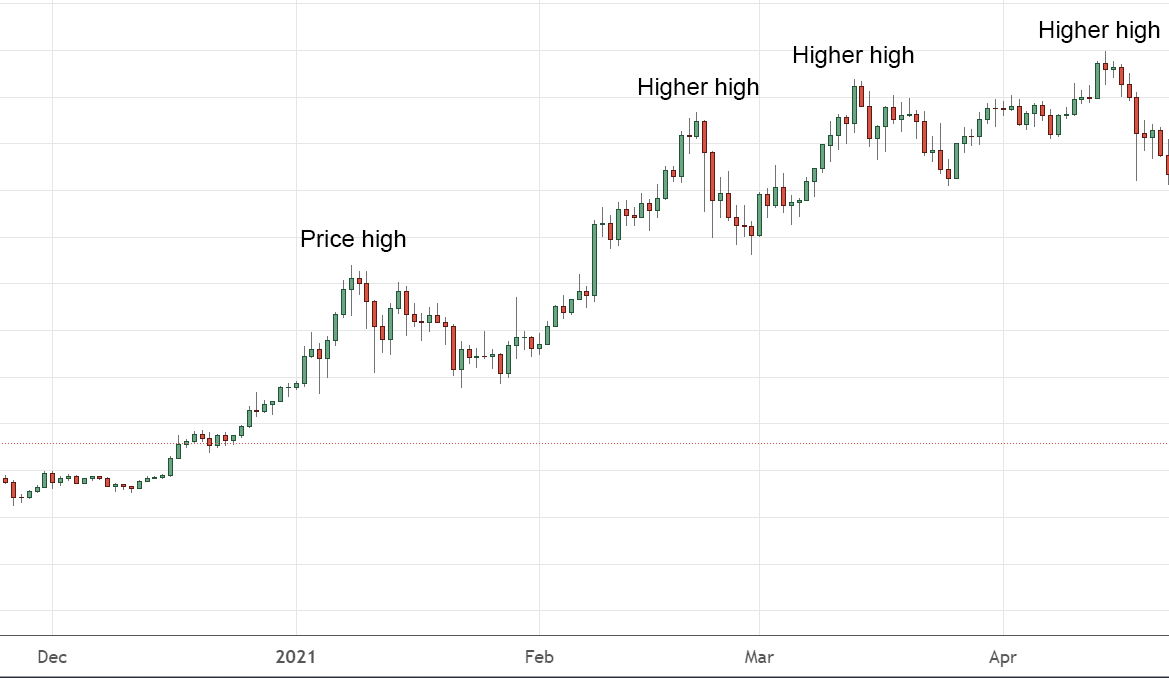

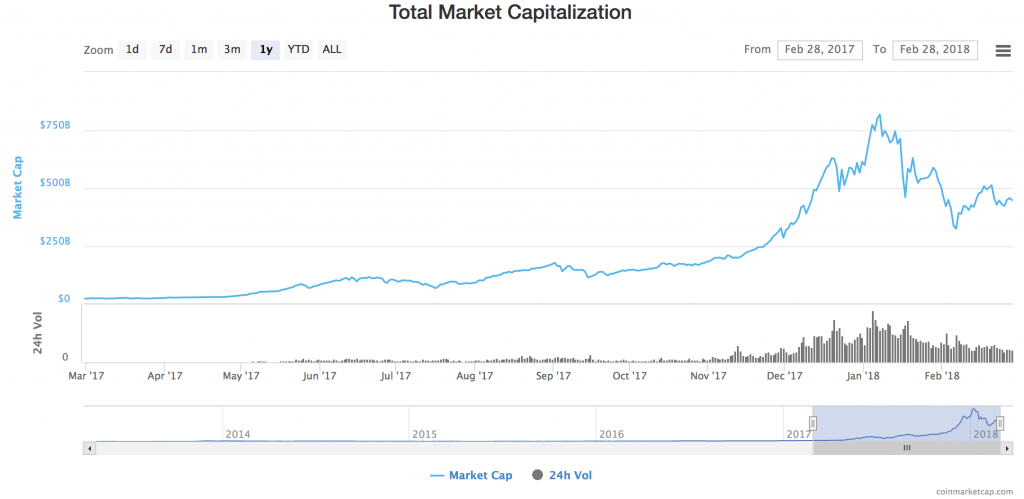

The current state of the cryptocurrency market offers a fascinating picture. Prices for many digital currencies are fluctuating dramatically. Bitcoin remains a leader, making it a go-to option for investors. Other coins like Ethereum & Binance Coin are also popular. Each coin has its trends & patterns. Market capitalization indicates overall health & investor interest.

As more users adopt cryptocurrencies, the value changes. Institutional investments are increasing. Major companies are investing in Bitcoin & other cryptocurrencies. This bolsters trust in the market.

Regulatory perspectives also shape the landscape. Governments worldwide enact rules that impact crypto trading. Strict regulations can lead to sell-offs or market corrections. Conversely, favorable regulations can enhance prices & trading volume.

Decentralized finance (DeFi) is a significant driver of activity. Users engage in lending, borrowing, & trading without intermediaries. DeFi projects are in demand due to their innovative solutions.

| Cryptocurrency | Market Cap |

|---|---|

| Bitcoin | $800 billion |

| Ethereum | $300 billion |

| Binance Coin | $50 billion |

Investor Sentiment & Behavior

Investor sentiment plays a crucial role in the cryptocurrency market. Social media platforms & news articles influence opinions. Positive news creates a bullish atmosphere. Negative news, Be that as it may, can lead to panic selling.

Market psychology changes with trends. Fear of missing out (FOMO) can drive rapid price increases. On the other hand, fear, uncertainty, & doubt (FUD) can trigger sharp drops. It’s essential for investors to remain calm & make informed decisions.

Recent surveys reveal changing attitudes toward cryptocurrency. Younger investors seem more enthusiastic. Many consider digital assets as a primary investment choice. Be that as it may, older generations tend to be more skeptical. Educating investors can help bridge this gap.

- FOMO often leads to hasty decisions.

- FUD can cause significant market drops.

- Education improves investor confidence.

Key Factors Affecting Cryptocurrency Prices

Several factors affect cryptocurrency prices. Market supply & demand is the most significant. Limited cryptocurrency supply can increase value. For instance, Bitcoin has a maximum of 21 million coins. As the number of available coins decreases, demand can drive prices up.

Regulation is another influential element. Countries implementing strict rules can negatively affect the market. Conversely, supportive policies can encourage investment & price growth.

Technological advancements also play a role. New blockchain features can enhance usability & security. This attracts more users & drives demand. An increase in adoption rates leads to higher prices.

| Factor | Impact on Price |

|---|---|

| Supply & Demand | High demand increases prices. |

| Regulations | Strict laws can lower values. |

| Technological Advancements | Improved features can boost demand. |

Future Predictions for the Cryptocurrency Market

Experts predict several trends for the future of the cryptocurrency market. One notable prediction focuses on mainstream adoption. As more businesses accept cryptocurrencies, usage will rise. This could stabilize prices & integration into everyday payments.

Another anticipated trend is the growth of decentralized finance (DeFi). DeFi projects likely will gain popularity. This could further disrupt traditional financial systems. Users appreciate the elimination of intermediaries. As innovations continue, more investors will likely explore these options.

Regulatory developments will also shape the market. Governments are expected to create clearer guidelines. These regulations can enhance trust in the market. A supportive regulatory environment may encourage more institutional investments.

Understanding the Role of Blockchain Technology

Blockchain technology significantly impacts the cryptocurrency space. It ensures security, transparency, & decentralization. Transactions recorded on a blockchain are tamper-proof. This attracts users who prioritize safety.

Innovations in blockchain are essential for market growth. New projects introduce unique solutions to common problems. These advancements can increase the value of cryptocurrencies connected to them. For example, Ethereum enables smart contracts. This has opened new opportunities for businesses & developers.

The rise of non-fungible tokens (NFTs) also highlights blockchain’s versatility. NFTs have surged in popularity, promoting unique ownership of digital assets. Artists & creators benefit from selling unique creations in the digital marketplace.

- Blockchain ensures transaction transparency.

- Smart contracts automate various functions.

- NFTs are reshaping the digital ownership landscape.

Comparing Cryptocurrencies: A Snapshot

Investors often compare various cryptocurrencies. Each has unique features & use cases. Below is a brief comparison of popular options.

| Cryptocurrency | Main Use Case |

|---|---|

| Bitcoin | Store of value |

| Ethereum | Smart contracts & DApps |

| Ripple | Cross-border payments |

Evaluating various cryptocurrencies helps investors make informed choices. It is essential to analyze the project’s roadmap, team, & use cases. Investors should also compare historical performance to assess potential growth.

My Personal Experience with Cryptocurrency Market Trends

My experience in the cryptocurrency market has been enlightening. I started investing a few years ago. Initially, I was skeptical. Be that as it may, as I learned more, my perspective changed. I observed the dramatic price fluctuations, often driven by external factors.

Participating in various investment strategies gave me insight. Understanding market psychology improved my decision-making skills. I discovered that staying informed is vital in this fast-paced environment.

Challenges in the Cryptocurrency Market

While the cryptocurrency market offers opportunities, it also presents challenges. Volatility is a significant concern. Prices can swing widely within short periods. This unpredictability affects investor confidence & decision-making.

Security issues also pose challenges. Hacks & scams are prevalent, resulting in significant losses. Investors must implement strategies to protect their assets. Using cold wallets & enabling two-factor authentication are essential steps.

Regulatory challenges can also impact the market. Different jurisdictions impose their rules. Keeping track of these changes is vital for investors. Navigating this complex landscape requires diligence & consistent research.

- Volatility can discourage potential investors.

- Security measures are necessary to protect assets.

- Regulatory awareness is crucial for compliance.

Community Influence on Cryptocurrency Trends

The role of community in shaping the cryptocurrency landscape is crucial. Social media platforms allow users to share insights & trends. Platforms like Twitter & Reddit serve as hubs for discussion.

Community sentiment influences market movements. Positive discussions can boost prices. Active communities encourage adoption & innovation. Many new projects emerge from community contributions.

Collaborative efforts enhance education & awareness. Community-driven initiatives provide vital resources. Whether through forums or workshops, the community plays a pivotal role.

“The future of cryptocurrency depends on community engagement.” – Sarah Mitchell

Mainstream Adoption: A Key Focus for the Future

Many believe mainstream adoption is the future of cryptocurrency. More businesses are integrating digital payments. This trend increases accessibility & usability for everyday consumers.

Major financial institutions are exploring crypto services. Banks are offering crypto trading options & wallets. These developments lend credibility to the industry. As traditional systems integrate with crypto, confidence may grow.

Increased adoption leads to higher liquidity. More users in the market means greater trading volume. This can stabilize prices & reduce volatility. As more people use crypto, it may eventually rival traditional currencies.

- Businesses accepting crypto improve usability.

- Traditional institutions lend credibility.

- Higher adoption fosters liquidity.

Conclusion: Insights for Potential Investors

The cryptocurrency landscape is dynamic. Understanding market trends aids decision-making. Investors should focus on research & analysis.

Staying informed about regulations, technologies, & community trends is crucial. Knowledge enhances confidence & can increase success. Engaging with others in the space also provides valuable insights.

For anyone considering investing, patience & diligence are essential. The future may hold significant opportunities in the cryptocurrency market.

<<<<< Buy Now from Official offer >>>>>

Feature of Fox Signals

Fox Signals offers an impressive set of features designed for cryptocurrency enthusiasts. Users receive lifetime access upon purchase, ensuring they can utilize the tool for years to come. Upon redeeming their code within 60 days of purchase, users unlock a comprehensive suite of services that are continuously updated. One standout aspect of this product is that all future updates included in the Lifetime Plan are automatically available, reflecting Fox Signals’ commitment to enhancing user experience. And don’t forget, it’s essential to note that this deal is not stackable, which means users should carefully assess their needs before making a purchase.

- Lifetime access to all features.

- Automatic updates for the Lifetime Plan.

- Redeem within 60 days for full benefits.

- Non-stackable deal to maintain clarity in offerings.

- Diverse analytical tools for market trends.

Challenges of Fox Signals

While Fox Signals presents several features, users may encounter certain challenges. One common issue reported by users is the learning curve associated with mastering the platform. Some individuals find that the initial setup & navigation can be somewhat overwhelming. Similarly, there have been cases of compatibility problems with older devices or certain browsers, which could hinder the user experience.

Feedback from users often highlights that, initially, it may take time to grasp all functionalities. Some recommend training sessions or tutorials to become proficient. Potential solutions could include providing enhanced customer support or creating comprehensive guides to help users through the basics. Fostering a community forum where users can share tips & tricks might also alleviate challenges.

Lastly, users mention that while Fox Signals has many features, some may feel limited in scope compared to other market tools. Continuous updates can address these areas & enhance user engagement over time. Open channels of communication between the developers & users can lead to better feature implementations.

Price of Fox Signals

The pricing structure for Fox Signals is straightforward & designed to provide excellent value for users. Offering a Lifetime Plan grants users full access to all current features & future updates without ongoing costs.

| Plan Type | Price | Details |

|---|---|---|

| Lifetime Plan | $69 | Access to all features & updates |

This pricing makes it a cost-effective choice for those serious about enhancing their trading approach & staying updated with market trends. Users benefit from not paying recurring fees, giving excellent long-term value.

Limitations of Fox Signals

While Fox Signals offers various features, it also presents limitations that users should consider. For instance, it may lack some advanced analytical tools compared to other competitors. Users often express the desire for additional charting capabilities & deeper integration with various trading platforms. These missing features can hinder a more comprehensive trading strategy.

On top of that, user experience feedback suggests that the interface could benefit from a more user-friendly design. Simplicity in navigation could enhance the overall accessibility of the platform, especially for new users. Improvement in mobile functionality has also been noted, allowing traders to analyze data even while on the go.

To address these limitations, developers should continually solicit user feedback & prioritize enhancements based on user needs. On top of that, providing regular updates can help to resolve existing constraints & keep the platform relevant in a competitive market.

Case Studies

Case studies can illustrate how Fox Signals successfully aids users in achieving their trading goals. For instance, a user named John utilized Fox Signals to enhance his trading strategy significantly. After joining, John implemented real-time insights offered by the platform, helping him make informed trades. Within three months, John reported a marked improvement in his return on investment.

Another example is Sarah, a novice trader who initially struggled to navigate the complexities of the cryptocurrency market. After subscribing to Fox Signals, she found the comprehensive tools beneficial for her learning curve. Sarah joined community discussions & learned from experienced users. As a result, she confidently made profitable trades within six months & expressed satisfaction with the support she received.

The experiences of these users demonstrate how effectively Fox Signals can cater to varying levels of trading experience. Their stories showcase the impact of informed trading decisions guided by the features available on the platform.

Recommendations for Fox Signals

To maximize the benefits of Fox Signals, users should adopt several strategies. Firstly, take advantage of all available resources, including tutorials, webinars, & community forums. Actively engaging with these resources can significantly enhance user knowledge & trading capabilities.

Secondly, users should consider combining Fox Signals with other analytical tools to create a well-rounded trading strategy. Identifying complementary products can enable a deeper analysis of market trends & provide a broader perspective. This could involve using technical analysis software alongside Fox Signals for better results.

Lastly, stay updated with ongoing changes in the cryptocurrency market. Regularly reviewing trends & adjusting strategies accordingly can significantly impact trading success. Users are encouraged to take time each week to analyze their performance & adjust their strategies based on insights from Fox Signals.

Key Market Trends

- Increased institutional adoption.

- Mergers & acquisitions in crypto companies.

- Enhanced regulatory developments.

- Growth of decentralized finance (DeFi).

- Digital currencies backed by central banks.

Future Predictions

Looking towards the future, several predictions about the cryptocurrency market emerge. One prediction suggests that institutional investment will continue to grow, leading to increased market stability. As traditional financial players invest, innovative projects will likely accelerate.

And another thing, advancements in blockchain technology could lead to improved scalability & efficiency in cryptocurrency transactions. This would enhance user experiences & accessibility, attracting more participants to the market.

Regulatory frameworks are expected to evolve, providing clearer guidelines for the cryptocurrency sector. As rules & regulations become more defined, confidence among investors & businesses may rise, contributing to an overall market uplift.

Emerging Technologies Impacting Cryptocurrency

- Artificial Intelligence (AI) in trading strategies.

- Blockchain interoperability enhancing platform connections.

- Smart contracts driving automation in transactions.

- Internet of Things (IoT) integration with crypto.

- Privacy-focused technologies aiding data security.

Adoption Trends Within Global Economies

Adoption trends indicate that global economies are gradually embracing cryptocurrency solutions. Countries with unstable local currencies are particularly inclined to adopt digital assets as alternatives for transactions & savings. On top of that, with the rise in e-commerce, more businesses accept cryptocurrencies as payment methods, enhancing their trust & reliability.

And don’t forget, partnerships between financial institutions & cryptocurrency platforms are rising. As a result, improved accessibility to cryptocurrency services for everyday consumers is anticipated. These partnerships can potentially mainstream cryptocurrencies in traditional sectors.

As more individuals become aware of & educated about cryptocurrency, the chances of mass adoption increase. Educational programs focusing on blockchain could facilitate wider acceptance of cryptocurrencies across different demographics.

Market Volatility & Risk Management

Market volatility remains a significant concern for cryptocurrency investors. Sudden price fluctuations can lead to significant gains or losses. Therefore, appropriate risk management strategies become essential. One effective strategy is to diversify investment portfolios, reducing the impact of adverse market movements on total holdings.

And don’t forget, setting stop-loss orders can help secure profits & mitigate losses, allowing traders to maintain a disciplined approach. Traders should also stay updated on market news & trends, as quick responses can enhance their trading success.

Lastly, continuously educating oneself about market dynamics can equip investors with the tools needed to navigate volatility effectively. Understanding the underlying technology & market mechanics can lead to better-informed decisions in fast-moving environments.

Social Media Influence on Cryptocurrency

Social media significantly impacts cryptocurrency market trends. Platforms like Twitter, Reddit, & Telegram are central to cryptocurrency discussions, providing real-time information & fostering community engagement. Influencers & thought leaders often drive sentiment, leading to rapid price changes based on social media activity.

On top of that, social media platforms serve as influential marketing channels for new cryptocurrency projects. Successful marketing campaigns can generate substantial attention & investment, demonstrating the importance of social presence.

Investors should be cautious, as social media trends can lead to misleading information. It is crucial to verify news from credible sources & maintain a balanced perspective when assessing market developments influenced by social media.

Regulatory Environment & Its Impact

The regulatory environment surrounding cryptocurrency continues to evolve, significantly influencing market dynamics. Governments worldwide are assessing how best to implement regulations that protect consumers while allowing innovation. The clarity of these regulations can either foster growth in the cryptocurrency sector or impose limitations.

Increased scrutiny has already affected how cryptocurrency exchanges operate. Compliance with new laws often enhances credibility, providing consumers with protection against fraud. Conversely, stringent regulations can potentially stifle innovation & limit new projects from entering the market.

Keeping abreast of regulatory changes is essential for anyone involved in cryptocurrency trading. Understanding compliance requirements can help investors make informed decisions & navigate potential pitfalls arising from changing laws.

Technological Innovations Shaping the Future

Innovations in technology profoundly shape the future of cryptocurrency. For instance, developments in blockchain technology improve transaction efficiency & scalability. This has the potential to enhance user experiences, making cryptocurrencies more viable alternatives for everyday transactions.

On top of that, advancements in security measures, such as enhanced encryption & decentralized solutions, improve trust in the ecosystem. As concerns over security remain a barrier to adoption, these innovations will encourage even more users to consider cryptocurrency for their financial transactions.

Continuous research & development among developers welcome new ideas & improvements that can keep pace with market demands & technological shifts. Maintaining this momentum is crucial for ensuring that cryptocurrency remains relevant in the financial landscape.

Conclusion of Market Dynamics

- Active participation in cryptocurrency communities enhances knowledge.

- Responding quickly to market shifts can maximize gains.

- Understanding market trends facilitates better investment strategies.

- Technological advancements will continue changing financial landscapes.

- Education, risk management, & adaptability are key for success.

What are the current trends in the cryptocurrency market?

Current trends in the cryptocurrency market include increased adoption of decentralized finance (DeFi), rise in non-fungible tokens (NFTs), & a growing interest from institutional investors. And another thing, regulatory developments & technological advancements play significant roles in shaping these trends.

How do market conditions affect cryptocurrency prices?

Market conditions such as supply & demand dynamics, investor sentiment, & macroeconomic factors significantly influence cryptocurrency prices. High volatility is common, with prices reacting swiftly to news, events, & regulatory changes.

What impact do regulations have on the future of cryptocurrency?

Regulations can greatly impact the future of cryptocurrency by providing a framework for legitimacy, reducing fraud, & increasing investor confidence. Positive regulations may encourage growth, while harsh regulations could hinder innovation.

Are cryptocurrencies becoming more mainstream?

Yes, a growing number of businesses accept cryptocurrencies as payment, increasing their mainstream acceptance. Educational efforts & media coverage also contribute to broader public awareness & use.

What role do institutional investors play in cryptocurrency markets?

Institutional investors are increasingly entering the cryptocurrency markets, leading to greater legitimacy & stability. Their investments can influence market trends & cause significant price movements.

How does technological advancement influence cryptocurrency trends?

Technological advancements can enhance cryptocurrency platforms, improve security, & offer new functionalities. Innovations such as layer-2 solutions & cross-chain interoperability are driving current & future trends.

What are the predictions for the future of cryptocurrency?

Predictions for the future of cryptocurrency include continued adoption, potential regulatory clarity, & the development of new financial products that integrate digital currencies. Market dynamics will likely remain volatile, but overall growth is anticipated.

How does public perception affect cryptocurrency trends?

Public perception plays a vital role in shaping cryptocurrency trends. Positive media portrayal & successful case studies can boost investor confidence, while negative news can lead to market declines.

What should investors consider when looking at cryptocurrency trends?

Investors should consider market volatility, regulatory changes, technological developments, & overall market sentiment when analyzing cryptocurrency trends. A well-rounded understanding can aid in making informed investment decisions.

Is it wise to invest in cryptocurrency during market dips?

Investing during market dips can be strategic, as cryptocurrencies may offer growth opportunities at lower prices. Be that as it may, investors should conduct thorough research & assess their risk tolerance before proceeding.

What are the key indicators to watch for future cryptocurrency trends?

Key indicators to monitor include trading volume, market capitalization, regulatory news, social media sentiment, & technological advancements related to cryptocurrency projects.

<<<<< Buy Now from Official offer >>>>>

Conclusion

In summary, the cryptocurrency market is constantly evolving, bringing both challenges & opportunities. Staying updated on the latest trends is essential for anyone interested in this exciting space. We’ve seen growing interest from institutional investors & advancements in blockchain technology that could shape the future. As regulations develop & public adoption increases, the future predictions for crypto look promising yet uncertain. It’s important to do your own research & be cautious. Whether you’re an expert or a beginner, understanding these key insights will help you navigate the crypto landscape more effectively.

<<<<< Buy Now from Official offer >>>>>