Yes, SaaS (Software as a Service) can be considered a part of the fintech ecosystem. It provides cloud-based solutions that enhance financial services through automation, real-time analytics, & improved efficiency. By enabling financial institutions & startups to deploy software applications that streamline operations, manage risk, & enhance customer experiences, SaaS significantly impacts areas like payment processing, lending, & regulatory compliance. Thus, the intersection of SaaS & financial services fosters innovation, drives accessibility, & reshapes how financial products are delivered & consumed, making it a vital component of the fintech landscape.

Is SaaS a Fintech? Understanding the Intersection of Software & Financial Services. Discover how SaaS fits into the world of Fintech. Explore the blend of software & financial services in simple terms. Dive in now!

Fintech 101 – (1) The Fin, the Tech, & Fintech with SaaS Savvy

Is SaaS a Fintech? Understanding the Intersection of Software & Financial Services Fintech 101 – (1) The Fin, the Tech, & Fintech with SaaS Savvy Is SaaS a Fintech? Understanding the Intersection of Software & Financial Services

Understanding SaaS in Financial Technology

When exploring the realm of SaaS & its role within financial technology (or Fintech), insights emerge regarding how software as a service transforms traditional financial services. Numerous companies rely on SaaS platforms for efficient management. From billing processes to customer engagement, this model reshapes operations.

My personal journey with SaaS in Fintech started when I began utilizing various tools offered by different providers. Experiencing how these solutions streamlined reporting & automated many tasks while enhancing user experiences highlighted immense potential within this intersection.

Defining SaaS & Fintech

SaaS Overview

SaaS, or software as a service, offers cloud-based access to software applications. Users subscribe rather than purchasing licenses, allowing for flexibility & scalability. This delivery model significantly reduces overhead expenses associated with physical installations & maintenance, appealing strongly to various industries.

Businesses can obtain instant access, enabling faster deployment & reducing time spent on updates, security, or maintenance. SaaS solutions adapt easily, aligning with emerging business needs. In addition, many applications integrate seamlessly with existing systems, enhancing operational efficiency.

Fintech Defined

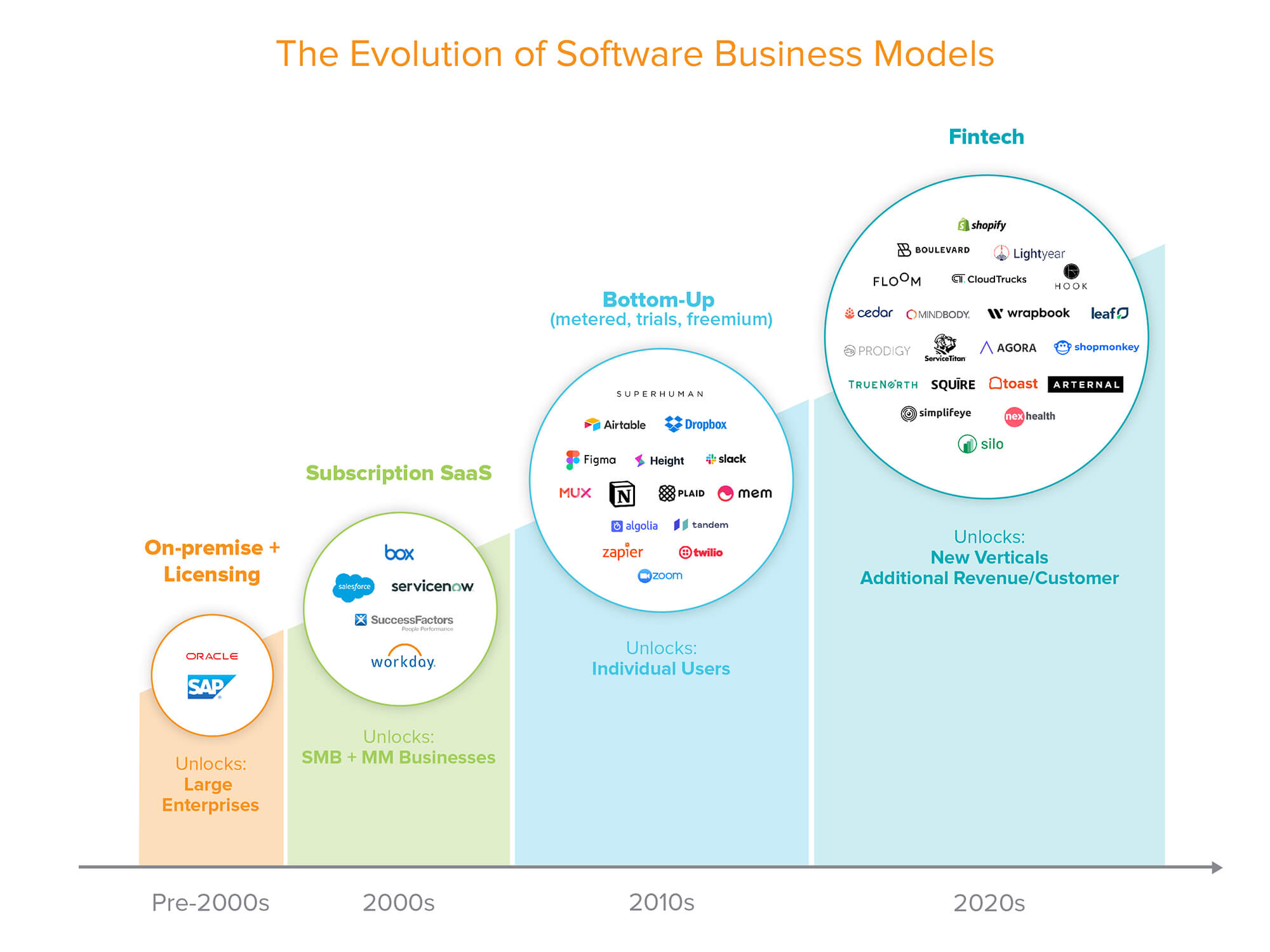

Fintech represents a broad category encompassing technology that enhances or automates financial services & processes. It includes everything from payment apps, online banking, investment platforms, blockchain technologies, insurance tech, & robo-advisors. Through innovation, Fintech aims to provide improved services for consumers as well as enterprises.

One key aspect of Fintech revolves around accessibility, enabling individuals & businesses previously excluded from mainstream financial systems to engage. This democratization fosters an environment where more people can take advantage of essential financial services.

Intersection of SaaS & Fintech

The alignment between SaaS & Fintech becomes apparent through various use cases & solutions that exhibit both characteristics. Many financial services now leverage cloud-based software, allowing for quick scalability while lowering operational costs. In addition, SaaS offers platforms enabling financial institutions to streamline processes, analyze data, & enhance customer engagement.

And don’t forget, SaaS models facilitate collaboration among teams, improving outcomes as they navigate compliance, risk management, & customer service. By offering a flexible infrastructure, financial institutions can swiftly adapt to market changes or regulatory requirements, fostering innovation.

Key Benefits of SaaS in Fintech

Cost Efficiency

Utilizing a SaaS model within Fintech generates substantial savings. Companies can minimize expenses associated with software installations, maintenance, & server management. Operating in a subscription-based model allows businesses to only pay for what they truly need, reducing wasted resources.

On top of that, this approach eliminates costs connected with large-scale hardware investments. Hence, smaller players within financial industries find opportunities previously unavailable, democratizing access to advanced tools.

Scalability & Flexibility

Another notable advantage lies in scalability that a SaaS solution offers. Financial organizations can quickly expand their operations without investing heavily in infrastructure. As client bases grow, they can adapt their software solutions, ensuring an efficient & streamlined delivery model.

This flexibility allows organizations to meet shifting demands while remaining competitive. New features or upgrades can be rolled out seamlessly across users, keeping businesses leading their respective fields.

Enhanced Security & Compliance

Security concerns remain paramount within Fintech. Utilizing SaaS solutions enables companies access high-level security measures that may otherwise prove costly or complex. Most reputable SaaS providers invest significant resources ensuring compliance with industry regulations while implementing advanced encryption & data protection measures.

Working with established providers ensures organizations maintain adherence with standards like GDPR or PCI-DSS, alleviating some burdens of compliance management. Outsourcing security aspects also frees internal teams to focus on core competencies while trusting external experts with compliance challenges.

Challenges of Integrating SaaS in Fintech

Data Privacy Concerns

The surge in SaaS adoption in Fintech raises valid concerns surrounding data privacy. Financial information holds sensitive characteristics, & organizations must safeguard client data effectively. Numerous regulations dictate stringent requirements around handling personal data, presenting a challenge for teams.

Organizations must invest time researching & verifying vendor security policies. In addition, firms should proactively address potential risks associated with data breaches or misuse to protect customers & maintain trustworthiness.

Vendor Lock-In

Another challenge stems from potential vendor lock-in situations. Transitioning between SaaS applications can require considerable resources. Choosing a provider involves evaluating long-term commitments. If organizations decide later to switch vendors, they might face complications migrating data or retraining teams.

Taking a careful, comprehensive approach during vendor selection helps mitigate future issues. And don’t forget, ensuring that data formats remain compatible across platforms aids in preserving ease during future transitions.

Dependence on Internet Connectivity

Dependence on reliable internet connections also poses challenges. Accessing SaaS applications requires stable connections. Businesses in areas with unreliable internet can face operational hurdles, leading to reduced efficiency & productivity.

Organizations often invest in enhancing their infrastructure or consider hybrid solutions that provide offline capabilities. Understanding current limitations is essential, enabling professionals to devise tailored solutions that address connectivity issues.

Notable SaaS Solutions in Fintech

Popular Platforms

- Stripe

- Square

- QuickBooks

- Xero

- Plaid

Investment Management Tools

- Wealthfront

- Betterment

- Robinhood

- Acorns

- M1 Finance

Digital Payment Solutions

- PayPal

- Venmo

- Zelle

- Google Pay

- Amazon Pay

Examples of SaaS in Action Within Fintech

Case Study: Personal Finance Management

One notable example can be observed through personal finance management applications like Mint or PocketGuard. These platforms utilize SaaS models, allowing users track spending habits, create budgets, & set financial goals. By aggregating data from various accounts, these tools offer valuable insights to help individuals achieve better control over their personal finances.

Such applications not only streamline budgeting processes but also enable insightful comparisons of spending across different categories. Users benefit from on-the-go access through mobile applications, ensuring that important financial information remains readily available.

Case Study: Automated Investment Services

Robo-advisors represent another innovative space where SaaS & Fintech intersect. Services such as Wealthfront & Betterment provide automated investment strategies through user-friendly interfaces. Clients complete risk assessments, allowing algorithms invest based on individual preferences while minimizing human involvement.

This approach not only democratizes investment options through lower fees but also attracts customers who might feel intimidated managing investments independently. By making complex investing accessible, these platforms contribute significantly to improved financial literacy & participation in capital markets.

The Future of SaaS in Financial Services

Emerging Trends & Innovations

Emerging trends suggest that SaaS adoption within Fintech will continue accelerating, particularly as new technologies arise. Innovations such as artificial intelligence, machine learning, & blockchain are reshaping how services operate. Strategies evolve around these technologies, resulting in smarter solutions providing enhanced customer experiences.

And don’t forget, as competition among Fintech companies intensifies, businesses seek ways improve their offerings. Technology partnerships & collaborations drive innovation forward, encouraging cohesive ecosystems across various platforms while elevating overall service quality.

Focus on Customer Experience

Heightened competition compels organizations to prioritize customer experience within Fintech solutions. That’s why many SaaS providers focus on developing user-friendly interfaces & seamless integrations with other platforms. Enhanced personalization allows users better engage, improving satisfaction & retention rates.

Companies utilizing data analytics will gain insights into customer preferences & behaviors, enabling them tailor products & services accordingly. Organizations that recognize these trends & adapt swiftly will gain a competitive advantage, maximizing client satisfaction.

Summary of Essential Aspects of SaaS & Fintech

| Aspect | Description |

|---|---|

| Cost Efficiency | Reduced overhead through cloud-based solutions. |

| Scalability | Quickly expand operations without heavy investments. |

| Security | Advanced measures ensure compliance & data protection. |

| Benefit | Detail |

|---|---|

| Flexibility | Adapt software solutions to changing business needs. |

| Data Analysis | Leverage analytics for improved decision-making. |

| Collaboration | Access tools that enhance team communication. |

“In today’s fast-paced financial environment, embracing SaaS solutions not only modernizes operations but also enhances competitive capabilities.”

Essential Characteristics Defining SaaS in Fintech

Integration Capabilities

Integration becomes crucial as various financial services seek a unified approach within their systems. Numerous SaaS platforms prioritize compatibility, enabling easier connections between software & existing technology stacks. This consideration fosters a robust framework capable of supporting multiple applications while maintaining seamless data flow.

As businesses aim to streamline operations & reduce errors, effective integrations enhance decision-making processes. Adopting a modular approach allows organizations customize solutions integrating only necessary components while maintaining flexibility to adjust as needs evolve.

User-Centric Focus

Given that customer experience remains central, many SaaS providers emphasize user-centric designs tailored toward financial service users. Grasping complex financial concepts can prove challenging; hence, accessible interfaces contribute significantly improving satisfaction. Streamlining functionality ensures that customers garner maximum value with minimal effort.

Training resources, customer support, & community engagement remain vital components in achieving user-centric goals. Providing consistent resources helps overcome learning curves associated with new software while fostering loyalty in a competitive landscape.

Final Thoughts on the Relationship Between SaaS & Fintech

Embracing the Future

Organizations within Fintech must keep pace with emerging technologies & trends impacting how they deliver services. By embracing SaaS, companies can revolutionize customer experiences, drive innovation, & optimize operational efficiency. Awareness of potential challenges & risks will enable organizations mitigate issues while still capitalizing on numerous benefits.

Establishing strong partnerships with reputable SaaS providers will be crucial in building a robust foundation for future growth. Adopting the right strategies can lead organizations toward success while concurrently offering customers personalized, efficient solutions to address evolving financial needs.

| Specification | SaaS (Software as a Service) | Fintech (Financial Technology) | Intersection |

|---|---|---|---|

| Definition | Cloud-based software accessed via the internet | Technology that enhances, automates, & streamlines financial services | Cloud-based financial applications |

| Delivery Model | Subscription-based or pay-as-you-go | Varies; can include subscription, transaction fees, or commission-based | Often subscription-based with added transaction services |

| Target Users | Businesses & individual users | Financial institutions, businesses, & consumers | Targeting both end-users & businesses |

| Examples | Salesforce, Dropbox | PayPal, Stripe, Robinhood | QuickBooks Online, Xero |

| Regulation | Generally less regulated | Heavily regulated due to financial compliance | Must comply with financial regulations |

| Integration | Integrates with various tools & APIs | Requires secure & efficient integrations with financial systems | Seamless integration with financial institutions |

| Data Security | Standard cloud security measures | High-level security due to sensitive data handling | Enhanced security protocols necessary |

| Scalability | High scalability based on subscription plans | Can be scalable but depends on regulatory frameworks | Flexible scaling options with financial services |

| Innovation Speed | Rapid, frequent updates | Fast-paced due to competitive market | Speeds up innovation in financial services |

| User Experience | Focus on UI/UX for general users | Focus on creating seamless financial user experiences | User experience tailored for both usability & compliance |

| Business Model | Recurring revenue model | Diverse monetization models (fees, percentages) | Combination of recurring & transaction-based models |

| Market Focus | Generalized across many industries | Focused on financial services & products | Niche focus within financial sectors |

| Customer Support | Standard support options available | Requires specialized support for financial queries | Enhanced support with financial expertise |

| Analytics | Data analytics features for business improvement | Advanced analysis for risk management & forecasting | Combines business analytics with financial insights |

| Technological Framework | Utilizes generic cloud technologies | Often uses specialized financial technology | Integrates both generic & specialized technologies |

| Customer Base | Diverse user base across various sectors | Primarily financial institutions, startups, & individual consumers | Engages a blend of tech-savvy users & financial professionals |

| Compliance | Less stringent compliance requirements | Strict compliance & regulatory standards | Requires adherence to both tech & finance regulations |

| Educational Resources | Wide range of tutorials & guides | Focused on financial literacy & technology integration | Resources emphasize both SaaS operation & financial literacy |

| Market Trends | Driven by cloud computing advancements | Driven by fintech innovations & user demand for convenience | Aligned with broader trends in both SaaS & fintech growth |

What is SaaS in relation to financial services?

SaaS, or Software as a Service, refers to a software distribution model where applications are hosted in the cloud & accessed via the internet. In the context of financial services, SaaS solutions provide tools & platforms that streamline financial operations, making them more efficient & accessible.

How does SaaS fit into the fintech landscape?

Fintech, or financial technology, encompasses a broad range of technological innovations in financial services. SaaS plays a vital role in this space by offering scalable, easily deployable software solutions that cater to various financial needs, such as accounting, payments, & investment management.

What are the advantages of using SaaS in fintech?

Utilizing SaaS in fintech provides numerous benefits, including lower upfront costs, reduced maintenance requirements, & increased scalability. It allows financial institutions to deploy new functionalities quickly & efficiently while enhancing collaboration & accessibility for users.

Are there any security concerns with SaaS in financial services?

While SaaS offers convenience, there are potential security concerns, especially in financial services. It is important for organizations to implement robust security measures, such as data encryption, access control, & regular compliance checks, to protect sensitive financial information.

How do regulations impact SaaS in fintech?

The fintech industry is highly regulated, & this impacts how SaaS solutions operate. Compliance with legal standards, such as data protection & anti-money laundering regulations, is crucial for SaaS providers to ensure that their offerings meet the required guidelines in the financial services sector.

Can SaaS models support traditional financial institutions?

Yes, SaaS solutions can greatly support traditional financial institutions by providing modern tools that enhance operational efficiency, improve customer experience, & facilitate innovation in product offerings. This supports a transition to a more digital & customer-centric approach.

What types of SaaS applications are commonly used in fintech?

Common types of SaaS applications in fintech include accounting software, payment processing platforms, customer relationship management (CRM) systems, & budgeting or financial planning tools. These applications help to automate processes & improve overall financial management.

How does SaaS change the way financial services are delivered?

SaaS transforms the delivery of financial services by facilitating access to software solutions from anywhere with an internet connection. This enhances user convenience, allows for real-time updates, & encourages collaboration among various stakeholders in the financial ecosystem.

What should businesses consider when choosing a SaaS provider for financial services?

Businesses should evaluate several factors when selecting a SaaS provider for financial services, including security measures, compliance with regulations, scalability, customer support, & integration capabilities with existing systems. A careful selection can ensure long-term success & reliability.

Is SaaS suitable for startups in the fintech sector?

Absolutely, SaaS is especially suitable for startups in the fintech sector due to its low initial investment & ease of scalability. Startups can quickly adapt & innovate without the burden of significant upfront costs associated with traditional software development.

Conclusion

In conclusion, understanding whether SaaS is part of the fintech world is essential in today’s digital age. When we see how software solutions are changing financial services, it’s clear that they are intertwined. SaaS platforms simplify everything from banking to budgeting, making everyday financial tasks easier for everyone. As technology continues to evolve, this relationship will only grow stronger. So, whether you’re a consumer or a business, embracing SaaS in your fintech journey can lead to smarter, more efficient solutions. It’s an exciting time to be part of this intersection!