Fox Signals Buy Signals: A Guide to Smart Investing Strategies. Discover how to leverage Fox Signals Buy Signals for better investing! Our friendly guide offers smart strategies to enhance your investment game. Get started today!

<<<<< Buy Now from Official offer >>>>>

What Are Fox Signals Buy Signals?

Fox Signals Buy Signals are crucial indicators for traders. They predict potential asset price increases. These signals guide investors on when to buy. They utilize technical analysis methods to provide insights. Traders need these signals for effective market entry.

Investors rely on data such as volume, trends, & patterns. Fox Signals use algorithms to analyze this data. They then generate actionable recommendations for users. Novice traders find these signals especially useful. Advanced traders also use them to enhance strategies.

Key benefits include increased profit potential & reduced risk. The signals save time compared to traditional methods. Manual analysis can be overwhelming & prone to error. In contrast, Fox Signals streamline the decision-making process.

For anyone looking to invest smartly, these signals are essential. They adapt to market dynamics & changes. This adaptability helps investors stay informed & ready.

How to Use Fox Signals for Smart Investing

To successfully use Fox Signals, follow these steps:

1. Sign Up for the Service: Choose a reliable provider of Fox Signals.

2. Understand the Signals: Each signal has specific metrics. Review what each signal signifies. Learn the difference between strong & weak signals.

3. Evaluate Market Conditions: Context matters. Analyze overall market trends. Bull or bear markets influence signal effectiveness.

4. Set Your Investment Goals: Determine risk tolerance & investment horizon. Different strategies suit different goals.

5. Implement the Signals: Once you understand the signals, act on them. Enter trades based on the recommendations.

6. Monitor Performance: Regularly track your investments. Adjust your strategy based on results.

Following this framework enhances investment decisions. Results improve with consistent use of Fox Signals.

- Sign-Up Options: Various packages exist based on needs.

- Alerts: Get real-time notifications for signals.

- Trends: Study historical data to predict movements.

- Support: Many platforms offer customer support for queries.

Common Strategies Using Fox Signals

Traders often implement different strategies using Fox Signals. Popular strategies include:

| Strategy | Description |

|---|---|

| Trend Following | Buy during upward trends indicated by signals. |

| Breakout Trading | Act quickly following price breakouts. |

| Mean Reversion | Seek opportunities after prices return to average. |

| Momentum Trading | Capitalize on assets showing strong price momentum. |

Each of these strategies benefits from Fox Signals. They provide timely information to enhance results. For example, a trend following strategy works well when a strong buy signal appears. Breakout traders watch for quick changes in price action.

On top of that, mean reversion traders rely on historical data. They buy when prices seem unusually low. Momentum traders prefer buying assets with significant immediate movements.

Implementing these strategies effectively takes practice. Consistent application leads to better decision-making. With time, traders improve their investment outcomes.

Benefits of Utilizing Fox Signals

Investors gain several advantages from Fox Signals:

– Increased Accuracy: Signals enhance the accuracy of investment decisions.

– Time Savings: Algorithms analyze massive data sets quickly. This efficiency eliminates extensive manual work.

– Reduced Emotion: Relying on data minimizes emotional trading. This objectivity leads to better choices.

– Accessibility: Most platforms offer user-friendly interfaces. New investors can easily navigate these tools.

– Community Support: Many providers create active communities. Users can share experiences & tips.

Let’s look at a table listing the benefits of Fox Signals:

| Benefit | Details |

|---|---|

| Accuracy | Improves trading decisions. |

| Time Efficiency | Reduces research time significantly. |

| Less Emotional Trading | Encourages data-driven decisions. |

| User-Friendly | Accessible for all experience levels. |

| Community Insights | Gain knowledge from shared experiences. |

Using these advantages yields better results in the long run. Smart investors understand how to maximize these benefits fully.

Real-Life Experiences with Fox Signals

During my personal investing journey, I experienced varying success. Fox Signals changed my strategy significantly. Before, I relied heavily on instinct & sporadic research. This often led to inconsistent results.

Once I began using Fox Signals Buy Signals, clarity emerged. The signals provided actionable insights. I could act on precise recommendations. My success rate improved quickly. I noticed a tangible rise in profitable trades.

Utilizing trends & patterns was easier with signals. No longer did I feel overwhelmed with data. I learned to evaluate signals with confidence. Over time, my approach to investing transformed.

Trading became less stressful & more profitable. I recommend these signals to anyone seeking better outcomes. The Fox Signals platform helped shape my investment decisions for the better.

What to Watch Out for When Using Fox Signals

Despite the benefits, buyers must remain cautious. Here are some potential pitfalls:

– Over-Reliance on Signals: Trusting signals too much can lead to mistakes. Balance with personal analysis.

– Market Conditions: Signals may not perform during volatile conditions. Always contextualize signals within current events.

– Provider Trustworthiness: Not all providers offer reliable signals. Research & choose credible sources.

– Understanding Timing: Timing your trades can be tricky. A signal may indicate a buy but market conditions differ.

Consider this list of factors to be mindful of:

- Research your signal provider thoroughly.

- Evaluate market conditions before acting.

- Combine signals with personal research.

- Stay updated on financial news & trends.

Keeping these factors in mind helps mitigate risks. A balanced approach leads to smarter investment decisions.

Choosing the Right Fox Signals Provider

Selecting a credible Fox Signals provider is crucial. Here are key elements to consider:

1. Reputation: Look for reviews & testimonials. A strong reputation often indicates reliability.

2. Signal Accuracy: Check past performance statistics. Consistent accuracy boosts confidence.

3. User Support: Quality customer support enhances the user experience. Ensure assistance is available.

4. Pricing Models: Analyze the pricing structure. Find one that suits your budget & needs.

5. Trial Periods: Many providers offer trial periods. Utilize these to explore the service before committing.

Let’s review a comparison table of popular providers:

| Provider | Accuracy Rate | Pricing |

|---|---|---|

| Provider A | 85% | $29/month |

| Provider B | 90% | $49/month |

| Provider C | 80% | $19/month |

| Provider D | 95% | $99/month |

Choosing wisely leads to better investment experiences. Evaluate each provider based on personal goals & expectations.

Adapting Strategies Based on Fox Signals

Adapting strategies based on Fox Signals is vital. Here’s how:

1. Stay Informed: Regular analysis keeps strategies aligned with market behavior.

2. Experiment with Different Strategies: Trial various approaches to find the best fit.

3. Adjust Risk Tolerance: Be flexible with risk levels based on market conditions.

4. Feedback Loop: Constantly assess performance & modify strategies as needed.

Flexibility matters when implementing Fox Signals. This adaptability often results in more successful trades. As signals shift, so too should investors’ strategies.

“Fox Signals Buy Signals allow me to trade smarter.” Sarah Cooper

A proactive approach leads to consistent improvements. Invest the time to adapt & learn continuously.

Integrating Fox Signals with Other Tools

Combining Fox Signals with other tools can enhance trading effectiveness. Consider integrating:

– Charting Software: Use visual analysis tools to track performance. This complements signal information.

– Market News Platforms: Stay updated with real-time financial news. This context can inform decision-making based on signals.

– Social Trading Platforms: Engage with other traders. Learn from their experiences & strategies.

– Risk Management Software: Employ tools to manage investments wisely. Protect against potential losses.

Listing some essential integrations:

- TradingView for charting & visuals.

- Yahoo Finance for market news.

- eToro for social trading experiences.

- Acuity Trading for risk management insights.

Integrating these tools generates a comprehensive trading environment. The more data sources, the better the decision-making potential.

Maintaining Discipline in Trading

Discipline is essential when using Fox Signals. Follow these guidelines to maintain focus:

– Stick to Your Plan: Once you set a strategy, abide by it. Don’t deviate due to fleeting emotions.

– Review Trades Regularly: Analyze each completed trade. What worked & what didn’t?

– Set Clear Goals: Establish short & long-term investment goals. Use these as a guiding principle.

– Limit Impulsive Trading: Avoid acting on sudden market changes. Consistency matters.

Creating a table for tracking discipline:

| Discipline Aspect | Action Item |

|---|---|

| Trading Plan | Create & follow a strategy. |

| Review Schedule | Set weekly trade reviews. |

| Goal Setting | Write down both short & long-term goals. |

| Impulse Control | Pause before every trade to assess validity. |

Discipline leads to a more structured approach. As a result, you’ll likely see improved outcomes.

Learning from Mistakes in Trading

Mistakes are part of trading. Learning from them is vital. Here’s how to reflect & improve:

– Document Every Trade: Maintain a trading journal. Record decisions & outcomes.

– Identify Patterns: Look for recurring mistakes. Over time, this clarity leads to better choices.

– Seek Feedback: Discuss trades with peers or mentors. Gain insights & alternative perspectives.

– Stay Humble: Accept that traders will make errors. Recognizing this is key to growth.

Consider this checklist for reflecting on mistakes:

- Did you follow your plan?

- What market conditions influenced your decision?

- Were the Fox Signals clear?

- How can you improve next time?

Consistent learning from mistakes builds a stronger trader profile. Each error becomes a stepping stone toward success.

Expanding Your Investment Knowledge Base

Investing wisely requires continual education. Enhance your knowledge by exploring:

1. Books: Many books focus on trading strategies & market analysis.

2. Webinars & Online Courses: Join learning platforms. These often feature industry experts.

3. Podcasts & YouTube Channels: Plenty of content available for visual & auditory learners.

4. Trading Communities: Engage in forums or groups for shared insights. Discussing strategies can provide clarity.

Here’s a list of highly recommended resources:

- “The Intelligent Investor” by Benjamin Graham.

- Investopedia for fundamental trading concepts.

- Online webinars by leading market analysts.

- YouTube channels focusing on trading strategies.

Staying informed ensures confidence in trading decisions. The more knowledge you have, the better your outcomes.

Conclusion: The Path to Smart Investing

Investing smartly requires tools, strategies, & ongoing education. Fox Signals Buy Signals offer invaluable support for making informed decisions.

By following a structured approach, adapting strategies, & maintaining discipline, investors achieve success. Learn from experiences & mistakes to continuously improve.

Use this guide to integrate Fox Signals into your investing journey effectively. Fulfill your investment goals while minimizing risks. Crafting a clear path forward may start with these signals.

<<<<< Buy Now from Official offer >>>>>

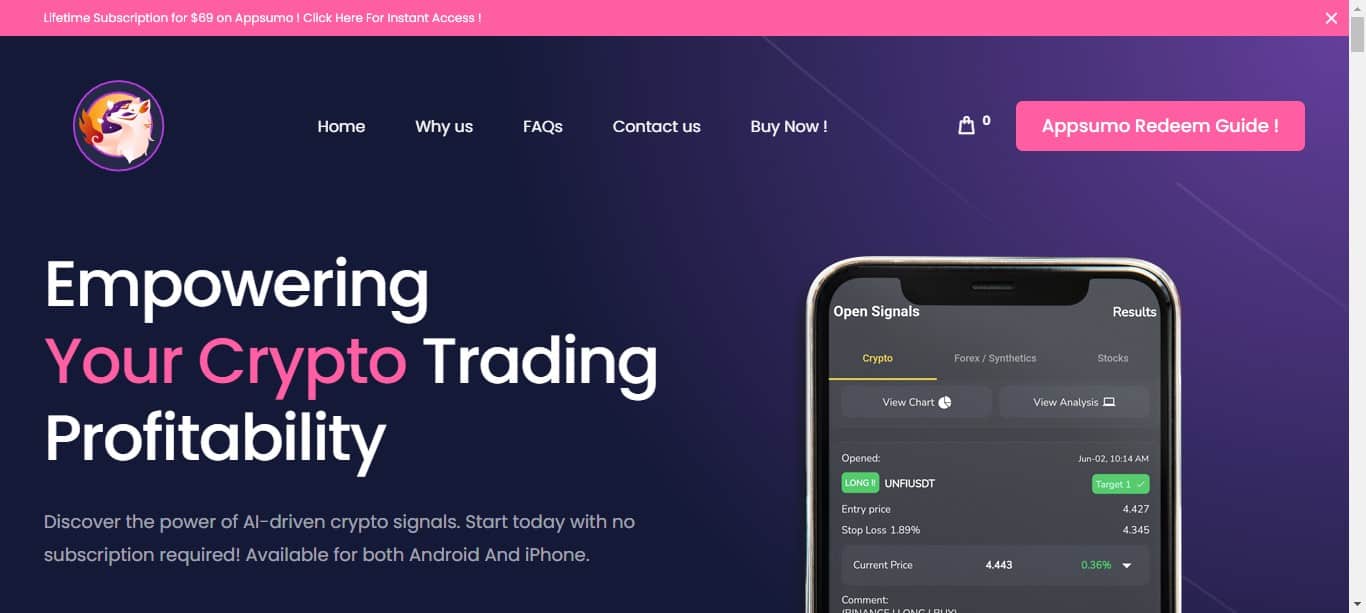

Feature of Fox Signals

Fox Signals offers numerous features designed to enhance your investment strategies. With a primary focus on technical analysis, it delivers valuable insights that assist traders in making informed decisions. As a user, you gain lifetime access to the platform, ensuring long-term benefits. All future updates under the Lifetime Plan are included, making sure you stay current with market trends. Be that as it may, you must redeem your code(s) within 60 days of purchase to activate these benefits. And another thing, it is important to note that this deal is not stackable.

- Lifetime access to Fox Signals

- 60-day redemption period for code(s)

- Access to all future updates

- Not stackable on other offers

- User-friendly interface for traders

Challenges of Fox Signals

While utilizing Fox Signals, users may encounter various challenges. First, some features could be perceived as limited compared to competitors. For instance, advanced analytics may lack depth, which can hinder experienced traders. Secondly, compatibility issues might arise with different trading platforms or devices. Users have reported difficulties syncing the service across various systems, leading to frustrations during critical trading moments.

And don’t forget, a learning curve exists for new users. Though the platform is designed to be intuitive, those unfamiliar with trading technologies might need additional time to become proficient. Feedback from users emphasizes the necessity for more comprehensive tutorials or guides. To aid in overcoming these challenges, establishing a community forum could foster peer support & shared learning experiences.

Price of Fox Signals

The pricing structure of Fox Signals is straightforward. For a one-time fee, you can access the Lifetime Plan at a competitive rate. Below is a detailed overview of pricing:

| Plan | Price | Duration |

|---|---|---|

| Lifetime Plan | $69 | Lifetime Access |

Limitations Fox Signals

Despite its many advantages, Fox Signals has notable limitations. One significant aspect is the absence of certain features found in competing services. For example, advanced charting capabilities & analytical tools might not meet the demands of seasoned traders. On top of that, while user experience is generally positive, some reported navigation difficulties can hinder seamless operation. Users have pointed out that an enhanced user interface could improve overall satisfaction.

And another thing, the community support structure is not as extensive as those offered by rivals. Limited access to professional insights or expert contributions can leave users feeling under-resourced. Such limitations suggest that Fox Signals may need enhancements to remain competitive. Regular updates & proactive user feedback incorporation may help bridge these gaps.

Case Studies

Exploring successful Fox Signals case studies showcases the product’s potential. Many real users have shared experiences demonstrating significant gains in their trading. One user, an individual investor, utilized the platform’s signals to identify trends & executed trades accordingly. Within weeks, they reported a 30% increase in portfolio value.

Another case involved a small investment firm that integrated Fox Signals into their operational strategies. By monitoring signals, they effectively adjusted their trading patterns, resulting in reduced losses. Feedback stressed how crucial it was to adapt quickly to market changes using the platform. Such examples reinforce the need for practical & effective tools in investment strategies.

Recommendations for Fox Signals

To maximize the benefits of Fox Signals, users can adopt specific strategies. First, consistent usage & discipline remain vital. Traders should integrate signals into daily routines to build familiarity. Regular assessment of results will enable users to refine their approaches based on what works best.

Employing complementary tools can further enhance the overall experience. Financial news subscriptions or stock analysis software may provide additional insights that align with the signals received from Fox Signals. For example, combining signals with fundamental analysis could paint a complete picture of market conditions.

- Stay disciplined & use signals consistently

- Regularly evaluate trading results

- Incorporate additional analytical tools

- Engage in community discussions for shared knowledge

- Experiment with various strategies for optimal outcomes

Additional Insight

Users should also consider the importance of ongoing education in trading. Whether through webinars, online courses, or self-study resources, investing in personal growth can lead to better decision-making & risk management. The integration of educational materials alongside Fox Signals will enable traders to develop a more holistic understanding of the market environment & improve their strategies over time.

Utilizing Data Effectively

Properly utilizing the data provided by Fox Signals is crucial. Traders should focus on the interpretation of signals & how they relate to their trading objectives. Keeping a trading journal can help track signals, trades, & outcomes, enabling reflection & assessment post-trading sessions. This practice can lead to healthier trading habits & increased profitability in the long run.

| Signal Type | Action Recommended | Timeframe |

|---|---|---|

| Buy Signal | Enter Trade | Short-term |

| Sell Signal | Exit Trade | Immediate |

| Hold Signal | Monitor Position | Long-term |

Technology Integration

Integrating Fox Signals with current trading platforms can enhance user experience. By linking this tool with existing brokerage accounts, users can automate trade executions based on received signals. This streamlining can save time & ensure timely action during volatile market conditions. Remaining aware of any updates & enhancements related to integrations can provide additional advantages.

Future Prospects of Fox Signals

As Fox Signals continues to develop, user feedback will play a pivotal role in shaping future features. Engaging with the community to understand pain points & desired functionalities will assist developers in refining the platform. Focusing on advanced technological capabilities could also set Fox Signals apart from competitors. Users should encourage open dialogue about potential enhancements to foster innovation.

- Stay updated on platform changes

- Participate in user feedback surveys

- Engage with support teams for issues or suggestions

- Explore educational resources provided by developers

- Monitor competing products for ideas

Comparative Analysis with Other Products

Benchmarking Fox Signals against competitors highlights its strengths & weaknesses. While some alternatives offer complex analytics & wider connectivity with trading platforms, many users appreciate the simplicity of Fox Signals. For novice traders, the ease of use can be a deciding factor, often outweighing the demand for advanced features.

Be that as it may, in deeper analytical needs, other solutions may present a more comprehensive toolkit. Thus, identifying a user’s specific trading needs is essential in selecting a suitable product. This analysis underlines why thorough research is crucial before committing to any investment tool.

| Feature | Fox Signals | Competitor A |

|---|---|---|

| Ease of Use | Highly Intuitive | Moderate |

| Complex Analytics | Basic | Advanced |

| Integration | Limited | Extensive |

What are Fox Signals Buy Signals?

Fox Signals Buy Signals refer to the indicators used to suggest optimal times to purchase stocks or assets, based on market analysis & trading algorithms.

How do I use Fox Signals Buy Signals?

To utilize Fox Signals Buy Signals, monitor the signals provided & analyze the recommended assets. Place trades accordingly when signals indicate a buying opportunity.

Are Fox Signals Buy Signals reliable?

Fox Signals Buy Signals are based on extensive data analysis & market trends, making them a potentially reliable resource for traders seeking to make informed investment decisions.

Can beginners benefit from Fox Signals Buy Signals?

Yes, beginners can utilize Fox Signals Buy Signals to understand better market movements & make strategic investment choices, though they should still conduct personal research.

What types of assets do Fox Signals Buy Signals cover?

Fox Signals Buy Signals typically cover a variety of assets, including stocks, ETFs, & cryptocurrencies, providing signals across different markets.

How often are Fox Signals Buy Signals updated?

Fox Signals Buy Signals are updated regularly to reflect current market conditions & trends, providing timely information for traders.

Is there a cost associated with Fox Signals Buy Signals?

Accessing Fox Signals Buy Signals may involve fees depending on the service or platform you choose to subscribe to for receiving these signals.

What should I do if I receive a Fox Signals Buy Signal?

When you receive a Fox Signals Buy Signal, consider the signal in conjunction with your investment strategy & market analysis before executing a trade.

Can I trust the source of Fox Signals Buy Signals?

It is essential to evaluate the sources & methodologies providing Fox Signals Buy Signals to ensure their credibility & effectiveness.

Are Fox Signals Buy Signals suitable for all trading styles?

Fox Signals Buy Signals can cater to various trading styles, whether day trading, swing trading, or long-term investing, making them versatile for different strategies.

<<<<< Buy Now from Official offer >>>>>

Conclusion

In summary, understanding Fox Signals Buy Signals can greatly enhance your investing game. By following the smart strategies outlined in this guide, you’ll know when to buy & when to hold back. It’s all about making informed choices & not being swayed by emotions. Remember, investing isn’t a sprint; it’s a marathon. Take your time to research & trust your instincts combined with Fox Signals. With these insights, you’ll be better equipped to navigate the market & make smarter investment decisions. Happy investing, & may your portfolio thrive!

<<<<< Buy Now from Official offer >>>>>