PayPal is not classified as a traditional Software as a Service (SaaS) platform; rather, it operates primarily as a payment processing service. While it offers cloud-based solutions for online transactions & integrates with various SaaS applications to facilitate payments, its core function is enabling financial transactions rather than providing software for general business use. PayPal leverages cloud services to enhance scalability, security, & efficiency in processing payments, but its main focus remains on facilitating digital payments & e-commerce rather than delivering a standalone software service.

Is PayPal a SaaS? Understanding PayPal’s Business Model & Cloud Services. Discover if PayPal is a SaaS. Dive into PayPal’s business model & learn about its cloud services in simple, easy-to-understand terms.

DON’T Upgrade to PayPal Business! Watch this first

Is PayPal a SaaS? Understanding PayPal’s Business Model & Cloud Services DON’T Upgrade to PayPal Business! Watch this first Is PayPal a SaaS? Understanding PayPal’s Business Model & Cloud Services

Understanding PayPal’s Business Model

PayPal represents one of most recognized names within digital payment solutions. Its fundamental approach primarily revolves around facilitating transactions between users seamlessly, making financial interactions easy & efficient.

Through an expansive network, customers can make purchases, send money, receive funds, or manage finances from numerous devices, which has contributed tremendously toward its growth. Essentially, PayPal has positioned itself as a financial intermediary, bridging gaps among buyers & sellers across various platforms.

In addition, diverse revenue streams enhance its business model. Charges on transactions, currency conversions, & fees for premium services all contribute significantly. PayPal continues evolving its offerings while expanding into additional markets, thus broadening its user base & increasing revenue potential.

Defining SaaS (Software as a Service)

Software as a Service, or SaaS, denotes application software delivery model that utilizes cloud computing technology. Rather than requiring installations on individual devices, software runs on cloud servers managed by third-party providers.

This arrangement affords users access via internet browsers, making software available anytime, anywhere. Subscription-based pricing models characterize most SaaS products, enabling flexibility for organizations of varying sizes.

Advantages encompass automatic updates, scalability, & cost-effectiveness, making SaaS attractive to businesses wanting agility without hefty upfront investments. Numerous SaaS tools exist across many industries, simplifying tasks & streamlining processes for users worldwide.

Examining PayPal’s Services

PayPal’s suite encompasses several products tailored for diverse needs. These include personal payments allowing money transfers between friends or family, as well as merchant services aimed at businesses seeking secure payment processing.

On top of that, PayPal provides online invoicing systems that facilitate bill management & payment collection for freelancers & small business owners. Trust & security play pivotal roles in its function, safeguarding transactions & instilling confidence among users.

International functionality further elevates its services, with support for multiple currencies, thereby promoting global commerce. PayPal connects businesses & consumers across borders, generating possibilities previously unimaginable.

Assessing Whether PayPal Qualifies as SaaS

While certain aspects align, designating PayPal strictly as a SaaS can be complex. Primarily operating as a transactional platform, its emphasis centers on payment processing, which inherently contains software components.

Yet, core functionalities remain tied closely with financial transactions rather than traditional software applications. Therefore, while PayPal utilizes SaaS principles, such as cloud infrastructure & accessibility, it doesn’t completely fit conventional definitions.

Evaluating PayPal’s features reveals integration with various e-commerce platforms. This suggests operational attributes parallel those of a SaaS service, enhancing customer experience through streamlined payment solutions.

Comparative Analysis of PayPal & SaaS Examples

| Aspect | PayPal | Typical SaaS |

|---|---|---|

| Delivery Model | Cloud-based transaction processing | Cloud-based service delivery |

| Functionality | Payment processing | Software applications |

| Pricing Model | Transaction fees, subscriptions | Subscription-based |

Advantages of Utilizing PayPal’s Services

PayPal offers myriad benefits for users spanning multiple demographics. Security consistently ranks high among customer priorities, with extensive measures safeguarding financial data during transactions.

Convenience follows as another forte, with streamlined user interfaces & mobile applications providing easy access across all devices. Users appreciate smooth experiences when managing funds, enhancing overall satisfaction.

Integration within countless e-commerce platforms expands its usability further. Businesses leveraging PayPal not only simplify payment processing but also enhance customer trust through association with reputable brands.

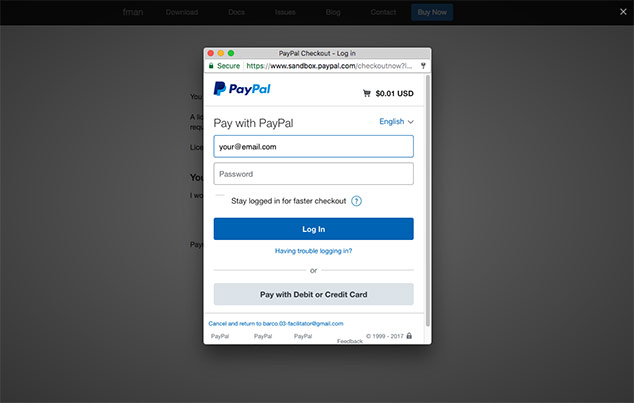

Security Measures Implemented by PayPal

Security represents critical concern regarding online transactions. PayPal undertakes numerous initiatives aimed at protecting user data & preventing fraud. Robust encryption protocols encrypt sensitive information, ensuring secure transfers.

On top of that, monitoring systems continuously analyze transactions for suspicious activity, prompting alerts where necessary. This vigilant approach fosters trust among users, reinforcing PayPal’s reputation as a reliable payment processor.

Educational resources empower users, providing guidelines on enhancing security. By promoting best practices, such as enabling two-factor authentication, PayPal demonstrates commitment toward fostering secure digital transactions.

Integration of PayPal with Other SaaS Tools

Integration capabilities bolster PayPal’s flexibility, allowing seamless connections with numerous SaaS tools. E-commerce platforms, accounting software, & customer relationship management (CRM) systems have all adopted PayPal, enhancing their functionalities through integrated payment solutions.

Such integrations facilitate smoother operations for businesses. For instance, synchronizing transactions with accounting systems helps maintain accurate financial records without manual entries. This efficiency attracts customers seeking enhanced operational capabilities.

And another thing, many businesses favor solutions that enable comprehensive ecosystems where various applications communicate effortlessly. PayPal excels within this space, allowing services to collaborate, thereby streamlining workflows across organizations.

Exploring PayPal’s Competitive Landscape

PayPal contends within a competitive market. Competitors include Square, Stripe, & other payment processors vying for dominance. Each company presents unique offerings catering toward various business needs.

Understanding competitors provides insight into PayPal’s market positioning & potential areas for growth. While PayPal boasts extensive brand recognition & established user trust, newcomers often introduce innovative features that attract modern businesses.

Continuously evaluating competitors allows PayPal to strategically adapt, ensuring its relevance in an ever-evolving landscape characterized by technological advancements & shifting consumer preferences.

Characteristics of PayPal’s Revenue Model

PayPal’s revenue model encompasses diverse channels. Transaction fees represent a primary source, generated each time users make payments or receive funds. This creates predictable income, allowing for accurate forecasting.

Currency conversion fees also contribute, particularly in international transactions. As businesses & consumers transact across borders, conversion rates become opportunities for revenue generation through associated costs.

Premium offerings add another dimension, with various subscription-based models & enhanced services appealing specifically toward businesses requiring advanced functionalities.

Users’ Experiences with PayPal

Personal experiences indicate that utilizing PayPal emerges as both straightforward & efficient. Navigating its interface & managing transactions can occur with minimal learning curve, highlighting platform’s user-friendliness.

On top of that, prompt transaction processing enhances overall satisfaction, providing confidence that monetary transfers happen quickly & securely. PayPal’s reputation remains reassuring for both businesses & consumers alike.

It becomes apparent that PayPal continually prioritizes user experience, fostering an ecosystem where managing finances feels effortless, thus encouraging loyalty among customers.

Key Features of PayPal Services

- Easy payment processing across global markets

- Robust security measures protect sensitive data

- Support for multiple currencies enables international transactions

- Integration with various e-commerce platforms enhances usability

- User-friendly mobile application promotes convenience

Strengthening PayPal’s Continuity through Innovation

Innovation remains pivotal for any organization aiming toward lasting success. PayPal actively seeks opportunities to enhance its services, leveraging technology while adopting new trends.

Emerging technologies such as blockchain & AI prompt exploration of potential applications that might streamline operations further or enhance user experiences. By remaining agile, PayPal ensures relevancy in an environment marked by rapid change.

Focusing on user feedback also plays a critical role in this process, allowing PayPal to identify areas needing improvement or additional features that resonate with customers, ensuring ongoing engagement.

The Future Outlook for PayPal

Future strategies involve not just retaining current customer bases but also attracting new users across different demographics. Expanding services tailored for emerging markets could unlock vast potential, presenting new revenue streams.

Continual assessment of financial technology trends responsibility defines direction toward innovation & sustainability. Maintaining commitment towards enhancing security & accessibility furthers PayPal’s standing as a trusted payment processor.

In anticipation of potential shifts within financial landscapes, proactively addressing user needs through adaptive rapid responses characterizes optimal operational strategies.

“PayPal’s evolution reflects broader shifts within financial technology ecosystems, positioning itself for future growth while maintaining customer trust.”

Comparative Overview of Payment Processing Solutions

| Processor | Transaction Fees | Currency Support |

|---|---|---|

| PayPal | Varies by country & transaction type | Over 100 currencies |

| Square | Fixed percentage per transaction | Primarily USD |

| Stripe | Flat rate per transaction | Multiple currencies supported |

Utilizing Integrations with PayPal

- Streamlined invoicing processes

- Automatic syncing with accounting systems

- Enhanced customer relationship management capabilities

- Centralized sales tracking across platforms

- Support for various shopping cart solutions

Understanding PayPal’s Expansion Strategies

PayPal consistently ventures into new markets, identifying regions with burgeoning digital payment needs. By providing localized solutions to address specific market demands, it positions itself favorably.

Additions such as mobile wallet initiatives demonstrate efforts aimed at capturing younger demographics embracing mobile technologies for convenience. This strategic focus aligns with shifting trends towards digitization in finance.

In-depth market research assists in guiding these expansion initiatives, ensuring adaptability across varying customer preferences that exist globally.

Engagement Tactics Employed by PayPal

Customer engagement reflects a priority within PayPal’s operational strategy, facilitating retention & fostering loyalty among users. Interactive marketing campaigns & personalized experiences cater toward specific target audiences.

Social media engagement plays an invaluable role in outreach, creating conversations & fostering community among users. Timely responses during customer interactions enhance overall brand perception.

Providing educational content empowers users, particularly small businesses aiming towards digital transformation while utilizing payment solutions. This not only builds trust but also solidifies PayPal’s position as an industry leader.

Innovation & Adaptability at PayPal

Maintaining dividends towards innovation ensures PayPal’s competitive edge persists. From enhancing its existing products with new features, leveraging emerging technologies helps fulfill evolving consumer needs.

Adaptability serves as a vital trait whether responding swiftly during financial crises or adjusting marketing strategies during global events, PayPal exhibits agility, emphasizing resilience within operational frameworks.

Consistent exploration regarding new technologies remains crucial. Blockchain integration or AI-driven analytics represent viable avenues that could reshape financial transactions across industries, inviting ongoing growth.

| Specification | PayPal | Stripe | Square | Braintree | Adyen |

|---|---|---|---|---|---|

| Type of Service | Payment Processing SaaS | Payment Processing SaaS | Payment Processing SaaS | Payment Gateway SaaS | Payment Processing SaaS |

| Business Model | Transaction-based fees | Transaction-based fees | Transaction-based fees | Transaction-based fees | Transaction-based fees |

| Integration Options | API & SDK | API & SDK | API & SDK | API & SDK | API & SDK |

| Supported Currencies | Over 100 | Over 135 | Over 130 | Over 45 | Over 200 |

| Mobile Payment Support | Yes | Yes | Yes | Yes | Yes |

| Recurring Billing | Yes | Yes | Yes | Yes | Yes |

| Fraud Protection | Yes | Yes | Yes | Yes | Yes |

| Customer Support | 24/7 Support | 24/7 Support | 24/7 Support | 24/7 Support | 24/7 Support |

| International Availability | Yes | Yes | Yes | Yes | Yes |

| Cost | Pay-per-transaction | Pay-per-transaction | Pay-per-transaction | Pay-per-transaction | Pay-per-transaction |

| Custom Branding | Limited | Extensive | Limited | Extensive | Extensive |

| User Dashboard | Yes | Yes | Yes | Yes | Yes |

| PayPal Integration | Yes | Yes | Yes | Yes | Yes |

| Security Compliance | PCI DSS Certified | PCI DSS Certified | PCI DSS Certified | PCI DSS Certified | PCI DSS Certified |

| Chargeback Management | Yes | Yes | Yes | Yes | Yes |

| Multi-user Access | Yes | Yes | Yes | Yes | Yes |

| Sales Reporting | Yes | Yes | Yes | Yes | Yes |

| API Documentation | Comprehensive | Comprehensive | Comprehensive | Comprehensive | Comprehensive |

| Payment Options | Credit/Debit, PayPal balances | Credit/Debit, Apple Pay, Google Pay | Credit/Debit, Apple Pay, Google Pay | Credit/Debit, PayPal, Venmo | Credit/Debit, iDEAL, SEPA |

What is PayPal’s business model?

PayPal operates as a digital payments platform that allows individuals & businesses to make & receive payments online. Its primary revenue sources are transaction fees, subscription services, & interest from funds held in accounts.

How does PayPal provide its services?

PayPal offers its services through a web-based platform & a mobile application, enabling users to send & receive money digitally. It also partners with various e-commerce platforms to facilitate payments.

Is PayPal a cloud service?

PayPal utilizes cloud services to manage its infrastructure & scale its operations efficiently. This allows for secure transactions & data storage while ensuring availability & performance.

What types of transactions can be made using PayPal?

Users can make various types of transactions through PayPal, including personal payments, business transactions, & commercial payments for goods & services. They can also transfer funds internationally.

Does PayPal charge fees for its services?

PayPal typically charges fees for processing transactions, especially for business accounts. Fees can vary based on transaction type, currency conversion, & whether it is a domestic or international payment.

Can PayPal be integrated with other platforms?

Yes, PayPal can be easily integrated with various e-commerce platforms such as Shopify, Magento, & WooCommerce, allowing merchants to offer seamless payment options to customers.

Is PayPal a software as a service (SaaS) model?

While PayPal provides software-based services, it is primarily categorized as a digital payment platform rather than a traditional SaaS model, focusing on financial transactions rather than offering comprehensive software solutions.

What security measures does PayPal use?

PayPal employs advanced security measures, including encryption, fraud detection, & secure servers, to protect user information & transaction details from potential threats.

Does PayPal offer customer support?

Yes, PayPal offers customer support through various channels, including a help center, community forums, & direct customer service via phone & chat to assist users with their inquiries.

How does PayPal handle disputes?

PayPal has a resolution center designated for handling disputes between buyers & sellers. Users can file claims & work through issues related to unauthorized transactions or unsatisfactory purchases.

Conclusion

In summary, PayPal may not fit neatly into the SaaS category, but it does embody many characteristics of a software service. Its ability to provide a reliable platform for online transactions showcases its role in the digital economy. With features that simplify payments for users & businesses alike, PayPal stands out as an essential tool. Understanding PayPal’s business model helps us appreciate how it leverages cloud services to enhance the user experience. Overall, whether labeled as SaaS or not, PayPal undeniably plays a crucial role in the world of online finance.