Top Cryptocurrency Trading Indicators to Boost Your Trading Strategy. Discover the top cryptocurrency trading indicators that can supercharge your trading strategy. Learn simple tips to enhance your success today!

<<<<< Buy Now from Official offer >>>>>

What Are Cryptocurrency Trading Indicators?

Cryptocurrency trading indicators serve as essential tools. They help traders analyze market behavior. Multiple types of indicators exist, aiding in different strategies. Some focus on price movements, while others analyze volume or momentum. Using these indicators properly can significantly improve your trading success.

Using indicators can help you make informed decisions. These tools offer insights into current market trends. They provide information on price movements, trends, & potential market reversals. Some indicators work best in trending markets, while others excel in ranging markets. Traders can blend various indicators for a comprehensive view.

For example, a trader might use moving averages alongside momentum indicators. This combination often offers a clearer picture of market conditions. Penny stocks may require different indicators compared to established cryptocurrencies like Bitcoin. Thus, flexibility & adaptability in using these indicators are key.

More importantly, learning how to interpret these tools takes practice. New traders might find it overwhelming at first. But with experience, they can recognize what works for their trading style. This familiarity allows for more accurate predictions & improved trading strategies.

Over time, I found that utilizing these indicators improved my confidence in trading. After applying different analytical methods, I felt more in control of my trades. The results boosted my effectiveness & overall success rate, reinforcing the value of good indicators in trading.

Key Cryptocurrency Trading Indicators

The market is flooded with a variety of indicators. Be that as it may, a few stand out for their effectiveness. Below are some of the most commonly used cryptocurrency trading indicators.

| Indicator Name | Description |

|---|---|

| Moving Averages | Shows average price over a period. |

| Relative Strength Index (RSI) | Measures overbought or oversold conditions. |

| Bollinger Bands | Indicates volatility & price levels. |

| MACD | Tracks price momentum & trends. |

Choosing the right indicator can be challenging. Each indicator offers a unique perspective. Therefore, understand your trading strategy before selecting indicators. You may prefer momentum-based indicators or trend-following indicators.

Combining different types can yield better results. For instance, using a trend indicator with a momentum indicator can confirm or refute signals.

In addition, ensuring proper understanding of indicator mechanics is vital. For instance, RSI values range from 0 to 100. Values over 70 suggest overbought, while under 30 suggest oversold conditions. On the other hand, moving averages provide a smoothed price line over time. This helps traders identify price trends & determine entry or exit points.

Using Moving Averages in Trading

Moving Averages (MA) represent one of the simplest yet most effective indicators. They smooth out price data. This helps traders identify trends more easily. Traders commonly use two types of moving averages: Simple Moving Average (SMA) & Exponential Moving Average (EMA).

The Simple Moving Average calculates the average price over a specified period. For example, a 50-day SMA adds the closing prices for the last 50 days & divides by 50. This helps provide a clear view of the price trend over time.

Conversely, the Exponential Moving Average gives more weight to recent prices. This makes it more responsive to price changes. Traders often prefer EMA for short-term trading.

Traders can use moving averages to spot trends. For instance, a trader might enter a buy position when the shorter-term MA crosses above the longer-term MA. This technique is known as a “Golden Cross.” It signals a potential price increase. Conversely, a “Death Cross” occurs when the shorter-term MA crosses below. That indicates a potential sell signal.

- Identify the trend direction.

- Confirm signals with other indicators.

- Adjust timeframes based on trading strategies.

- Use MAs to find support or resistance levels.

Proper use of moving averages can enhance trading strategies significantly. Combining MAs with volume analysis can add an additional layer of confirmation.

Relative Strength Index (RSI) Basics

The Relative Strength Index (RSI) is a momentum oscillator. It measures the speed & change of price movements. RSI values range from 0 to 100. It’s primarily used to identify overbought or oversold conditions in an asset.

Using RSI can help traders make better decisions. Typically, an RSI above 70 indicates that a cryptocurrency is overbought. This means it may be due for a price correction. In contrast, an RSI below 30 signals oversold conditions. This suggests a potential price rebound might occur.

A common approach is to incorporate RSI trends into your trading strategy. For example, if the RSI moves above 70, it may indicate you should consider selling. On the contrary, if it falls below 30, it could be a sign to buy.

RSI can also exhibit divergence with price movements. For instance, if prices rise while RSI declines, it may indicate a weakening trend. This could provide a clue to exit the market before a downturn occurs.

| RSI Levels | Status |

|---|---|

| 0-30 | Oversold |

| 30-70 | Neutral |

| 70-100 | Overbought |

Incorporating RSI into trading strategies can yield significant benefits. Be that as it may, relying solely on it can be risky. Combined with other indicators, RSI can provide a more complete market picture.

Bollinger Bands Explained

Bollinger Bands consist of three lines plotted on a price chart. These lines include a middle band (SMA) & two outer bands (standard deviations above & below the SMA). They offer insights toward market volatility & price levels.

When the bands widen, it indicates high market volatility. Conversely, narrowed bands suggest low volatility. Traders can prepare for potential price movements when bands widen or contract.

Bollinger Bands also help identify potential buy or sell signals. A common strategy is to buy when the price touches the lower band. Conversely, a trader might sell when the price reaches the upper band. Be that as it may, traders should combine this with additional analysis for more accurate signals.

This indicator is especially useful for traders focusing on breakout strategies. When prices break out of the bands, it often signifies strong momentum. Be that as it may, it’s crucial to wait for confirmation before acting on these signals.

- Use Bollinger Bands for volatility analysis.

- Combine with other indicators for confirmation.

- Adjust the deviation settings based on market conditions.

- Utilize in ranging & trending markets.

Bollinger Bands also help set potential exit points. Keeping an eye on upper & lower bands can signal when to exit trades effectively.

MACD for Momentum Tracking

The Moving Average Convergence Divergence (MACD) is another vital indicator for traders. It tracks momentum & trend direction in an asset. The MACD consists of two lines: the MACD line & the signal line.

The MACD line is calculated by subtracting the 26-day EMA from the 12-day EMA. This shows trend direction & momentum shifts. The signal line, typically a 9-day EMA, further confirms these signals.

A common strategy is to look for crossovers between the MACD line & the signal line. If the MACD line crosses above the signal line, it indicates potential bullish momentum. Conversely, if the MACD line crosses below the signal line, it suggests bearish momentum.

Traders often look for divergences between the MACD & price. For example, if prices rise while the MACD declines, this could hint at an impending trend reversal.

| MACD Strategy | Action |

|---|---|

| Crossover Above | Buy Signal |

| Crossover Below | Sell Signal |

| Divergence with Price | Trend Reversal Alert |

Using MACD effectively can enhance your trading strategy. Combining it with candle patterns or other indicators can lead to more successful trades.

Integrating Indicators into Your Strategy

With various cryptocurrency trading indicators available, integrating them into your trading strategy is crucial. Begin by identifying your trading style. Do you prefer day trading or long-term holding? This preference will influence your choice of indicators.

Next, combine multiple indicators for a holistic view of the market. For example, using Bollinger Bands alongside RSI can help confirm signals before entering a trade. Likewise, moving averages can act as filters for potential trades based on momentum indicators.

On top of that, ensuring that indicators complement each other is essential. Avoid using multiple indicators that convey similar information. Instead, blend trend & momentum indicators for a balanced approach.

Also, keep in mind that practice is vital. Starting with demonstrations can enhance your understanding of how different indicators work together. Taking this time can prevent costly mistakes in actual trading conditions.

Lastly, adjusting your strategy based on market conditions is crucial. Trends can shift quickly in cryptocurrency markets. Staying adaptable & continually refining your strategy based on emerging data is key for sustainable success.

“Every trader should respect indicators. They tell a story about market behavior.” – Sarah Mulligan

By focusing on integrating indicators into your strategy, you can improve your analysis. Better analysis often leads to smart trading decisions & higher profit potential.

<<<<< Buy Now from Official offer >>>>>

Feature of Fox Signals

Fox Signals offers users lifetime access to its features. This is an excellent advantage for anyone looking to establish a long-term trading strategy. Users can redeem their code(s) within 60 days of purchase, ensuring quick access to all tools & resources.

Another notable feature is that all future Lifetime Plan updates are included. This means users benefit from continuous improvements without additional costs. Updates can provide insights into new trading indicators & methodologies, significantly enhancing user experience & knowledge.

Be that as it may, this deal is non-stackable. Users should consider this before making a purchase. While the features are appealing, understanding the limitations is equally essential for effective trading.

Challenges of Fox Signals

While Fox Signals provides various benefits, users may encounter specific challenges. One common issue is identified in the feedback regarding a learning curve. Many found initial navigation of features complicated. This often requires time & practice before users can leverage all available tools effectively.

Another challenge noted is compatibility issues. Some users reported difficulties integrating Fox Signals with existing trading platforms. Depending on the user’s chosen systems, they might experience limited functionality.

To address these challenges, users could consider additional training resources or tutorials. Engaging with community forums can also provide support & practical tips. It’s advisable to leverage all available resources for successful trading outcomes.

Price of Fox Signals

The pricing structure for Fox Signals is straightforward. Users can access the Lifetime Plan for a one-time fee of $69. This pricing model ensures affordability while allowing access to crucial trading tools.

| Plan | Price | Features Included |

|---|---|---|

| Lifetime Plan | $69 | Lifetime access, updates included |

Limitations of Fox Signals

Despite its advantages, Fox Signals does have certain limitations. One primary concern is the potential missing features. Compared to other trading tools, it may not provide some advanced analytics users want. This can lead to less comprehensive trading decision support.

User experience difficulties are another reported limitation. Some find the interface less intuitive, which can hinder smooth navigation. Such challenges may deter some individuals from utilizing its full potential.

Improvement areas, including user interface & added features, could elevate user satisfaction. Continued feedback from users can drive necessary updates, ensuring Fox Signals meets market demands.

Case Studies

Real-life experiences illustrate the effectiveness of Fox Signals. One user, a novice trader, joined Fox Signals with no prior knowledge of cryptocurrency trading. After utilizing the available signals, their trading accuracy improved significantly, leading to profitable trades.

Another user, an experienced trader, shared insights into using Fox Signals for advanced strategies. They combined signals with technical analysis, resulting in a refined approach that maximized their trading portfolio’s growth.

A case study of a group of traders using Fox Signals illustrates how they collectively benefited from shared knowledge & insights. They regularly discussed signals received & strategies applied, leading to improved overall results.

Recommendations for Fox Signals

To maximize benefits from Fox Signals, users should implement a few key recommendations. First, regularly review signals & correlate them with market news. Understanding trends helps in making informed decisions.

Users can also benefit from participating in community discussions. Engaging with fellow traders can provide new perspectives & insights for refining strategies. Networking can also lead to collaboration opportunities.

Finally, pairing Fox Signals with complementary tools can enhance user experience. Consider using analytical tools to supplement trading signals for more robust decision-making.

Essential Cryptocurrency Trading Indicators

- Moving Averages

- Bollinger Bands

- Relative Strength Index (RSI)

- MACD (Moving Average Convergence Divergence)

- Fibonacci Retracement

Popular Trading Strategies

- Scalping

- Day Trading

- Swing Trading

- Position Trading

- Trend Following

Understanding Market Conditions

Identifying market conditions is crucial for trading success. Market trends can affect strategy effectiveness. Recognizing when to trade can significantly enhance outcomes. Analyzing both bullish & bearish conditions will lead to informed trades.

Technical indicators help assess market sentiments & conditions. Usage of these indicators can provide insights into potential price movements. Strategies must be adaptable based on fluctuations in the market.

And another thing, staying updated on news & events can aid in understanding market reactions. Regulatory changes or technological advancements can rapidly alter market dynamics. This awareness influences users’ strategies & trading effectiveness.

A Comprehensive Look at Technical Analysis Tools

Technical analysis involves studying price patterns & market trends. It requires several tools to assist traders. These tools help in forecasting potential price movements & market behavior.

Many traders utilize charts for visual representations of data. Charting tools allow users to analyze price movements over time. Indicators such as moving averages & RSI are vital tools integrated within these charts.

Understanding how to use these tools effectively can vastly improve trading performance. Regular practice & exposure to various charting styles aid in refining analytical skills.

Key Metrics for Evaluating Performance

Traders should track several key metrics to evaluate their trading performance. Metrics such as profit & loss ratio provide insights into overall success & strategy effectiveness. Understanding these metrics informs necessary adjustments in tactics.

Risk-reward ratio is another critical component. It gauges potential returns against the risks taken in trades. A favorable ratio indicates positive trading conditions. Consistently monitoring these metrics will help maintain focus on trading goals.

And another thing, win ratios help compare successful trades against total trades executed. Frequent evaluation allows traders to understand their efficiency over time while facilitating adjustments to improve overall performance.

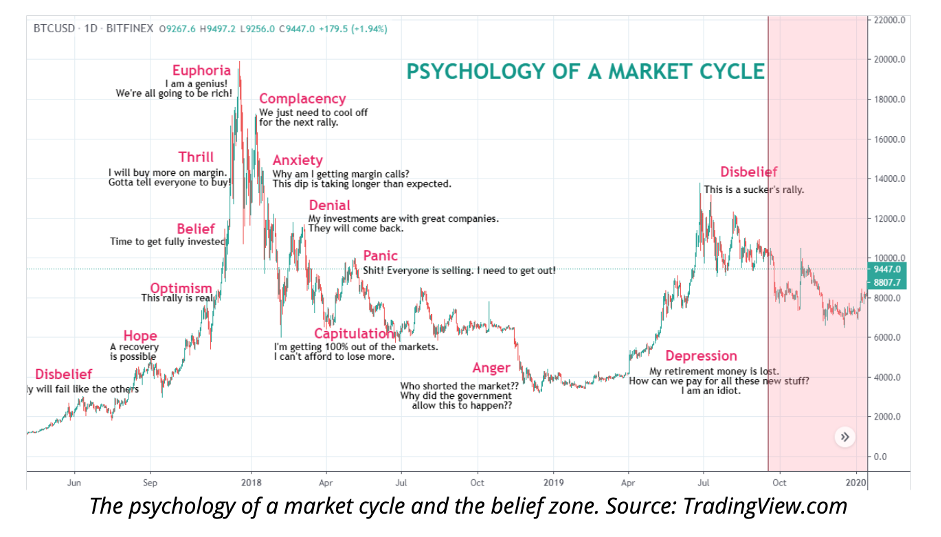

Using Sentiment Analysis in Trading

Sentiment analysis is crucial in understanding market psychology. It assesses traders’ & investors’ feelings about specific cryptocurrencies. This analysis can reveal trends that technical indicators may not yet reflect.

News headlines play a significant role in shaping market sentiment. Positive or negative news can influence the price movements of currencies. Traders should consider sentiment alongside technical analysis for well-rounded strategies.

And don’t forget, incorporating social media trends can enhance understanding of public sentiment. Social media platforms often provide insights into market dynamics & community discussions, which can be valuable for traders.

Essential Chart Patterns for Traders

Chart patterns provide insights into market behaviors. Recognizing these patterns can help traders make informed decisions. Some enduring patterns include head & shoulders, double tops, & triangles.

Each pattern has particular meanings & implications for price movements. For instance, a head & shoulders pattern often indicates an impending downturn after a bullish trend. Being familiar with these formations is vital for effective trading.

And another thing, monitoring volume alongside patterns helps verify signals. Increased volume usually supports significant price movements, confirming patterns observed on charts.

Risk Management Strategies

Effective risk management is fundamental in trading. It involves identifying, analyzing, & mitigating potential losses. Establishing clear rules for entry & exit points can safeguard against substantial losses.

Implementing stop-loss orders is a common tactic to limit risk. These orders automatically execute positions once a predetermined loss threshold is met. This strategy helps protect capital in volatile markets.

Another strategy involves diversifying your portfolio. Spreading investments across various assets can reduce reliance on a single asset. Diversification mitigates risk & may lead to more stable returns over time.

Final Thoughts on Trading Improvement

Improving trading skills requires continuous learning & assessment. Regularly evaluating strategies & adapting to market changes will enhance overall performance. Staying informed about trends & tools can provide competitive advantages in the market.

Participating in trading communities can also support personal growth & development. Sharing experiences, discussing strategies, & learning from others contribute significantly to becoming a proficient trader.

Ultimately, achieving trading success stems from a combination of knowledge, experience, & effective strategy implementation.

What are the most popular cryptocurrency trading indicators?

The most popular cryptocurrency trading indicators include Moving Averages, Relative Strength Index (RSI), MACD (Moving Average Convergence Divergence), Bollinger Bands, & Fibonacci Retracement. Each of these indicators helps traders analyze price movement & market trends.

How do Moving Averages work in trading?

Moving Averages help smooth price data to identify trends over a specified period. They can be simple or exponential. A common strategy is to compare short-term & long-term moving averages to spot potential buy or sell signals.

What is the Relative Strength Index (RSI) & how is it used?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed & change of price movements. It ranges from 0 to 100, & a level above 70 suggests overbought conditions, while below 30 indicates oversold conditions.

Can you explain the MACD indicator?

MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that shows the relationship between two moving averages. Traders often look for signal line crossovers to identify potential buy or sell opportunities.

What do Bollinger Bands indicate in trading?

Bollinger Bands consist of a middle band representing a moving average & two outer bands that are standard deviations away. This indicator helps traders assess market volatility & potential price reversals.

How can Fibonacci Retracement be applied in trading?

Fibonacci Retracement levels are horizontal lines that indicate possible support & resistance levels based on the Fibonacci sequence. Traders use these levels to identify potential reversal points after a price movement.

What strategies can I use with these indicators?

Traders often combine multiple indicators, such as using RSI alongside Moving Averages for confirmation of trends. Backtesting strategies on historical data can also help refine approaches toward trading.

Are there any risks associated with using indicators?

While indicators can offer valuable insights, they are not foolproof. Market conditions can change rapidly, making it essential for traders to consider external factors & use indicators in conjunction with sound risk management practices.

How often should I check my trading indicators?

It varies by trading style. Day traders may need to check indicators multiple times per day, while swing traders might check them daily or weekly. It’s crucial to align the frequency with your individual trading strategy & goals.

What resources are available for learning more about trading indicators?

Many online platforms, including trading forums, educational websites, & YouTube channels, provide in-depth resources about cryptocurrency trading indicators. Books on technical analysis can also be beneficial for gaining deeper insights.

<<<<< Buy Now from Official offer >>>>>

Conclusion

In summary, using the right cryptocurrency trading indicators can make a big difference in your trading journey. By understanding tools like moving averages, RSI, & MACD, you can make more informed decisions. Don’t forget to combine these indicators with good risk management for even better results. Remember, trading is not just about making quick profits; it’s about developing a solid strategy. So take your time to learn & practice. With the right indicators & a clear plan, you can boost your trading strategy & navigate the exciting world of cryptocurrency with confidence!

<<<<< Buy Now from Official offer >>>>>