Top Signals for Smart Bitcoin Investment Decisions. Discover the top signals for making smart Bitcoin investment decisions. Learn simple tips to boost your confidence in trading today!

<<<<< Buy Now from Official offer >>>>>

What Is Bitcoin & Why Invest in It?

Bitcoin is a decentralized digital currency. It operates on blockchain technology. This allows for secure & transparent transactions. Many investors see Bitcoin as a store of value. It serves as a hedge against inflation. Due to its limited supply, its value can appreciate over time. More & more people are recognizing its importance. They are considering adding Bitcoin to their investment portfolios.

Investing in Bitcoin has become quite popular. Be that as it may, it is essential to make informed decisions. Various signals can help shape sound investment choices. Understanding these signals is crucial for any potential investor. They can provide insights into the best times to invest.

With my personal experience in Bitcoin investment, I learned the importance of timing. Initially, I jumped into Bitcoin without enough research. I faced losses before realizing the need for informed decisions. Analyzing the signals became vital for future investments.

Market Trends & Bitcoin Price Fluctuations

Keeping an eye on market trends is crucial for any investor. Bitcoin prices are influenced by various factors. It includes economic conditions, regulations, & technological advancements. Understanding these trends helps investors anticipate price movements.

Studying past price movements offers valuable information. Analyzing historical charts can reveal patterns. Investors can identify potential upward or downward trends.

| Year | Price at Start | Price at End |

|---|---|---|

| 2017 | $1,000 | $13,880 |

| 2018 | $13,880 | $3,800 |

| 2019 | $3,800 | $7,200 |

| 2020 | $7,200 | $28,900 |

Analyzing these trends helps investors determine when to buy. For instance, buying during a dip can yield significant returns later. A consistent upward trend may indicate a strong market. Conversely, a downward trend could mean caution is required.

Besides, following news sources is essential. Global events can lead to significant market shifts. Thus, staying informed is key to making strategic decisions.

The Importance of Market Sentiment

Market sentiment plays a critical role in Bitcoin investments. Investor psychology can heavily influence price movements. When individuals feel optimistic, they are likely to buy. Conversely, fear can lead to panic selling.

Traders often gauge market sentiment using several tools. These include social media trends, forums, & surveys. Observing these indicators provides insights into the current market mood.

- Bitcoin-related social media mentions

- Fear & Greed Index readings

- Investor sentiment surveys

Tools like the Fear & Greed Index aggregate data. This helps assess whether the market is overly fearful or greedy. A reading of extreme fear may signal a buying opportunity. On the other hand, extreme greed might indicate a potential sell point.

FOMO, or fear of missing out, often drives people to invest hastily. Such emotions can cloud judgment. Therefore, it’s important to remain level-headed while gauging market sentiment.

Technical Analysis: A Fundamental Tool

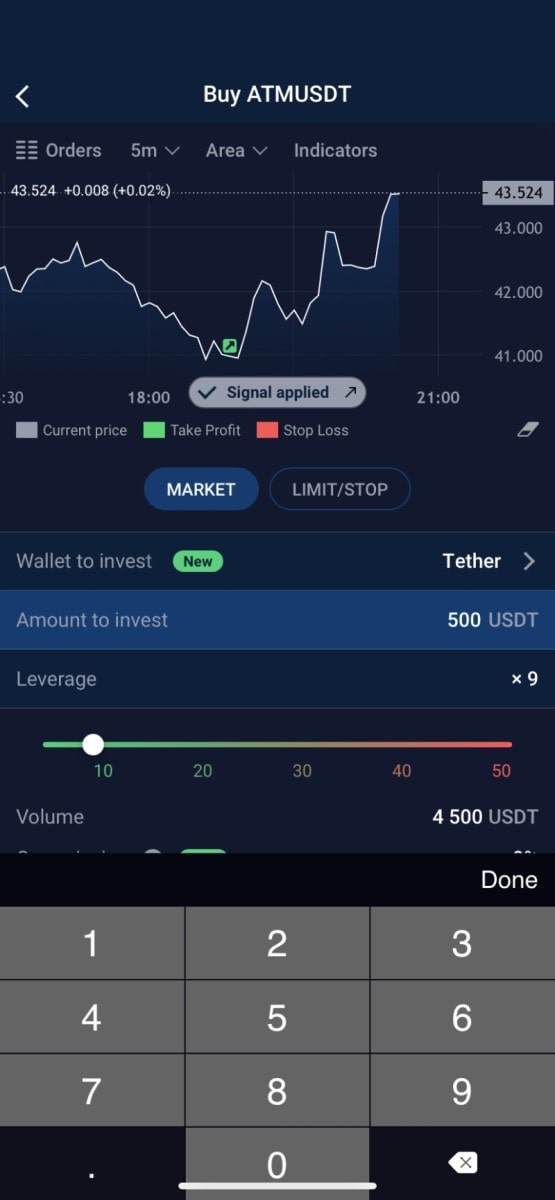

Technical analysis (TA) is vital for discerning trends. Investors should familiarize themselves with charts, indicators, & signals. Popular tools include Moving Averages, Relative Strength Index (RSI), & Fibonacci retracements.

Understanding these tools aids in predicting future price movements. By analyzing trends, investors can make well-timed decisions.

| Indicator | Purpose |

|---|---|

| Moving Averages | Identifies trend direction |

| RSI | Measures overbought or oversold conditions |

| Fibonacci Retracement | Identifies possible support or resistance levels |

For example, a Moving Average crossover can signal potential buy or sell points. Similarly, RSI readings can show whether Bitcoin is overbought or oversold.

Such analyses can help you catch trends early. Relying on technical indicators can reduce reliance on gut feelings. Instead, decisions can be based on data, enhancing investment strategies.

Fundamental Analysis: Evaluating Bitcoin’s Value

Fundamental analysis (FA) evaluates Bitcoin’s intrinsic value. This involves examining economic indicators, adoption rates, & the technology behind it. Investors must also look at supply & demand dynamics.

A key factor in Bitcoin’s value is its limited supply. There will only ever be 21 million Bitcoins. This scarcity can drive demand higher. As more people recognize Bitcoin’s potential, its value can increase.

- Adoption by mainstream institutions

- New regulations impacting Bitcoin

- Technological advancements (like the Lightning Network)

Monitoring these factors provides a comprehensive view of Bitcoin’s potential growth. Emphasizing FA can help investors make informed long-term decisions.

Investors must also consider competitor currencies. When new technologies emerge, they could pose threats or opportunities. Maintaining awareness of market changes is important for informed choices.

Risk Management Strategies in Bitcoin Investment

Implementing risk management strategies is essential in Bitcoin investment. It helps protect your portfolio from severe losses. One common practice is diversification. By spreading investments across various assets, risks can be minimized.

Investors can also utilize stop-loss orders. These allow selling a position once it reaches a specified price. This limits losses & secures profits.

| Strategy | Description |

|---|---|

| Diversification | Spread investments across different assets |

| Stop-Loss Orders | Sell at a predetermined price |

| Position Sizing | Limit amount invested in one asset |

Another strategy is position sizing. Investors determine how much of their portfolio to allocate to Bitcoin. By limiting exposure, they reduce potential losses.

Monitoring positions regularly is also critical. Constantly reviewing your portfolio ensures adjustments can be made. Identifying underperforming assets allows for timely replacements. This proactive approach helps safeguard investments.

The Role of News & Events in Bitcoin Price Movements

News & events can impact Bitcoin’s price dramatically. Major news outlets & social media play pivotal roles in shaping opinions. Investors should stay updated with the latest happenings.

Big events can lead to significant media coverage. For instance, when companies adopt Bitcoin, prices may skyrocket. Regulatory changes can either boost or detract from Bitcoin’s allure.

- New legislation impacting cryptocurrency

- Technological advancements in the Bitcoin sector

- Major businesses accepting Bitcoin payments

An announcement by a major corporation can create waves throughout the market. For example, when Tesla announced Bitcoin acceptance, prices surged.

Monitoring these events is vital for savvy investors. Be that as it may, it’s essential to filter through noise & identify credible sources. Sensationalized news can lead to misguided decisions.

Long-term vs. Short-term Investment Strategies

Investors must choose between two popular strategies. These are long-term & short-term investments. Each has its advantages & disadvantages.

Long-term investments in Bitcoin can provide substantial returns. Investors hold onto their assets through market fluctuations. This approach hinges on Bitcoin’s value appreciating over time.

Conversely, short-term investing can yield quick returns. Traders buy & sell Bitcoin within shorter periods. Timing market movements is crucial for this strategy.

| Strategy | Time Frame | Risk Level |

|---|---|---|

| Long-term | Months to Years | Low to Moderate |

| Short-term | Days to Weeks | High |

Each investor must assess their risk tolerance. Some may prefer holding onto Bitcoin for years. Others thrive on the excitement of fast trades. Identifying your style can guide investment choices.

It’s also crucial to re-evaluate regularly. Market conditions can shift rapidly. Adapting strategies ensures you can capitalize on new opportunities.

Using Bitcoin Indicators for Investment Decisions

Several essential indicators can guide investors in making strategic decisions. It includes network activity, transaction volume, & wallet addresses. Monitoring these indicators provides valuable insights.

For instance, a rising number of active wallets indicates growing interest. Increased transaction volume may signify heightened activity.

- Number of active wallet addresses

- Transaction volume on the blockchain

- Hash rate of the Bitcoin network

The Bitcoin hash rate represents the total computational power. A rising hash rate often indicates growing network security & trust. Increasing miner activity can boost confidence in Bitcoin’s stability.

Employing these indicators aids in identifying investments with potential. A comprehensive approach heightens the chances of successful trades.

Staying Informed: Resources for Bitcoin Investors

Keeping updated about Bitcoin is essential. Many resources provide valuable information & data. Engaging with communities can enhance your investment knowledge.

Popular online platforms cover Bitcoin-related news. Websites like CoinDesk & CoinTelegraph offer detailed articles. These platforms provide real-time updates & expert analyses.

- CoinDesk: News & price analysis

- CoinTelegraph: Updates on cryptocurrency regulations

- Bitcoin forums & Reddit communities

Participating in forums allows you to share opinions & tips. Online groups can be helpful for learning new strategies. Engaging with other investors enhances your investment acumen.

And another thing, learning from professional traders can provide insights. Many share their experiences & strategies online.

“Successful investing is about staying informed.” – Jordan McClure

Continually educating yourself helps navigate the complexities of Bitcoin investing. Understanding different factors allows for sharper decision-making.

Conclusion: Smart Investment Decisions Await

Investing in Bitcoin requires careful consideration. By utilizing signals effectively, you can maximize your potential. Keeping informed about price movements, market sentiment, & analysis tools will help. Implementing risk management & continually educating yourself enhances success. Remember, the Bitcoin market is dynamic, so adaptability is essential.

<<<<< Buy Now from Official offer >>>>>

Feature of Fox Signals

Fox Signals offers users an array of features that enhance Bitcoin investment strategies effectively. First, the product provides Lifetime access to its services, ensuring that subscribers receive ongoing benefits without recurring fees. Customers can redeem their code(s) within 60 days of purchase, allowing flexibility in activating their subscription when it suits them best. This feature is particularly beneficial for those wanting to test the waters before fully committing.

On top of that, users can benefit from All future Lifetime Plan updates. This means that subscribers continually gain access to new features & improvements as they are rolled out, ensuring the service stays relevant in a dynamic market. Continuous updates also indicate a commitment from the provider to enhance user experience.

Be that as it may, prospective users should note that this deal is not stackable. This means that promotions cannot be combined with other offers, encouraging users to make informed decisions before subscribing. Overall, these features create a comprehensive & appealing package for potential investors.

Challenges of Fox Signals

While Fox Signals offers many advantages, users may encounter challenges when utilizing the service. One common challenge includes limitations in features. Some users feel that certain analytical tools available in other competing products are absent in Fox Signals, which may hinder in-depth analysis.

Another issue involves compatibility with some devices or trading platforms. Although Fox Signals aims to be user-friendly, some users report difficulties accessing the service on specific software. This challenge could frustrate those who rely on integrated trading platforms.

The potential learning curve is also a concern. While the interface is designed to be intuitive, users unfamiliar with investment tools may find it initially complex. Feedback from users highlights the need for improved tutorials & customer support. Providing step-by-step guides could alleviate this challenge & enhance user satisfaction.

Price of Fox Signals

The pricing structure for Fox Signals is straightforward. It offers a clear & affordable plan that enables users to manage their investments without overspending. Below is a pricing overview:

| Plan Type | Price | Details |

|---|---|---|

| Lifetime Plan | $69 | One-time payment for lifetime access |

This pricing makes Fox Signals accessible for many investors, especially those just entering the cryptocurrency market. The one-time fee allows users to avoid ongoing monthly charges, making budgeting more manageable.

Limitations of Fox Signals

Despite its useful features, Fox Signals has certain limitations. One significant limitation is the absence of advanced analytical tools that competitors may provide. Users often report wanting more features related to technical analysis, which would enhance trading strategies.

User experience also presents challenges. Some users experience a complicated interface when navigating through the system. Improving user interface design could enhance overall satisfaction & make the platform more appealing to new investors.

And another thing, Fox Signals may not cater to all investor types. Beginners may find it sufficient for their needs, but seasoned traders might desire functionality that is currently lacking. Expanding the toolset could attract a wider user demographic & improve user retention.

Case Studies

Examining success stories provides clearer insights into how users have effectively leveraged Fox Signals. For instance, one trader reported a 30% increase in his investment portfolio after using the signals provided for a consistent three months. He utilized alerts for purchasing times, leading to substantial gains.

Another user focused on short-term trading & capitalized on market trends identified through Fox Signals. His experience demonstrated how timely alerts can influence quick decisions & improve profit margins. The feedback from this user specifically highlighted the effectiveness of real-time notifications.

A small investment firm began using Fox Signals as part of its trading strategy. They reported that the tool enabled them to optimize client portfolios effectively. They attributed their recent growth in clientele directly to the ability to provide clients with data-driven insights derived from the signals.

Recommendations for Fox Signals

To maximize the benefits of Fox Signals, users should consider several actionable strategies. First, users can schedule regular reviews of signal updates. Establishing a consistent routine ensures one stays informed about market changes & adjustments in strategies.

And another thing, pairing Fox Signals with other analytical tools can enhance investment strategies further. Subscribing to services that offer complementary insights, such as portfolio management tools, will provide a more holistic approach to trading.

Finally, users should consider joining online communities centered around Fox Signals. Engaging with fellow users can offer additional insights, experiences, & tips that could assist in overcoming any challenges or maximizing the product’s features effectively.

Potential Benefits of Using Fox Signals

- Access to real-time signals

- Continual updates & improvements

- Cost-effective pricing

- Lifelong subscription

- Community support & resources

Key Features of Fox Signals

- Lifetime access to resources & updates

- User-friendly interface

- Timely alerts for investment opportunities

- Comprehensive guides & tutorials

- Dedicated customer support

Areas for Future Improvement

- Enhancing analytical tools

- Streamlining the user interface

- Improving compatibility with trading platforms

- Offering more educational resources

- Building stronger customer support channels

User Feedback

Many users have commented positively on their experiences. They highlight the affordability of the Fox Signals Lifetime Plan while noting the necessity for additional features. Many would be willing to pay more for enhanced functionalities & support.

Negative feedback often revolves around the user interface. Some users find navigation cumbersome & express a desire for a more straightforward design. Addressing these concerns could boost overall satisfaction considerably.

Despite some challenges, the majority of users appreciate the real-time signals & the impact that timely alerts have on their trading decisions. Continued engagement with the user community may provide beneficial feedback for product enhancements.

What are the key signals for smart Bitcoin investment decisions?

Key signals for smart Bitcoin investment decisions include analyzing market trends, monitoring trading volumes, assessing regulatory news, observing macroeconomic indicators, & following influential market players.

How can market trends affect Bitcoin investments?

Market trends can indicate whether Bitcoin’s price is likely to rise or fall. Bullish trends suggest increasing demand, while bearish trends signal potential declines in value.

Why is trading volume important in Bitcoin investments?

High trading volume can indicate strong investor interest & confidence, while low volume may suggest uncertainty or a lack of interest in Bitcoin.

What role does regulatory news play in Bitcoin investment decisions?

Regulatory news can significantly impact Bitcoin’s price & market stability. Positive regulatory developments can boost investor confidence, while negative news may lead to sharp declines in value.

How do macroeconomic indicators influence Bitcoin investments?

Macroeconomic indicators, such as inflation rates & interest rates, can impact investor behavior & Bitcoin’s value, as they shape the overall economic environment.

Who are the influential market players to watch?

Influential market players include large institutional investors, renowned traders, & influential analysts whose opinions & moves can sway the market.

What technical analysis tools can be used for Bitcoin investment?

Technical analysis tools like moving averages, RSI, & Bollinger Bands can help investors predict future price movements & identify potential entry & exit points.

How can social media sentiment impact Bitcoin prices?

Social media sentiment can serve as a gauge of public perception towards Bitcoin. Positive discussions may lead to price increases, while negative sentiment can cause declines.

What is the significance of Bitcoin’s historical price behavior?

Analyzing Bitcoin’s historical price behavior can provide insights into potential future movements, helping investors identify patterns that may repeat.

How do external events influence Bitcoin prices?

External events, such as technological advancements, security breaches, or geopolitical tensions, can have immediate effects on Bitcoin’s market value & investor sentiment.

<<<<< Buy Now from Official offer >>>>>

Conclusion

In summary, making wise decisions in Bitcoin investing requires paying attention to important signals. By focusing on market trends, keeping an eye on news, & understanding the basics of supply & demand, you can improve your chances of success. Remember to be patient & avoid impulsive actions. It’s also smart to set realistic goals & not to invest more than you can afford to lose. By following these top signals, you’re better equipped to navigate the Bitcoin market. Stay informed, trust your research, & always stay cautious as you take steps into the exciting world of Bitcoin investment.

<<<<< Buy Now from Official offer >>>>>