Beginner’s Guide to Crypto Trading: Tips, Strategies, & Best Practices. Discover our Beginner’s Guide to Crypto Trading! Get easy tips, smart strategies, & best practices to start your journey in crypto with confidence.

<<<<< Buy Now from Official offer >>>>>

What is Crypto Trading?

Crypto trading involves the buying & selling of cryptocurrencies in various markets. It aims to capitalize on price fluctuations. Traders can profit by buying coins at low prices & selling them at higher prices. Many people participate in this market hoping to make a profit. Be that as it may, it also carries risks. Understanding how crypto trading works is vital for success.

The market operates 24/7, allowing traders to execute trades at any time. This flexibility attracts people from all backgrounds. Different platforms facilitate trading, including exchanges & brokerages. Each platform may offer unique features, so choosing the right one is essential.

Cryptocurrencies vary greatly. Bitcoin, Ethereum, & Litecoin are popular examples. New coins appear frequently. Each coin has its own dynamics, influencing its price. Consequently, traders must research coins before trading them. Market analysis is also crucial for making informed decisions.

Crypto trading may seem overwhelming for beginners. Be that as it may, with proper education, it can be manageable. Many resources are available to help new traders learn the basics. Building a strong foundation is necessary before diving deeper into advanced concepts.

Getting Started in Crypto Trading

For those interested in entering this market, starting will involve a few key steps. The first step involves choosing a reliable crypto exchange. This platform provides a space to buy, sell, & trade cryptocurrencies. Look for exchanges with good security features, low fees, & a wide variety of coins.

Next, you will need to create an account. Most exchanges require you to provide identification. This process varies by platform, so familiarize yourself with the requirements. Secure your account with strong passwords & two-factor authentication. Security is crucial in crypto trading, as hacks are common.

After setting up your account, the next step involves funding it. Most exchanges accept bank transfers or credit card payments. Some allow deposits in other cryptocurrencies. Always check the fees associated with deposits & withdrawals to avoid unexpected costs.

Once your account is funded, consider starting with a small investment. This method helps reduce risks while you learn. Monitoring the market will provide valuable insights as you grow more comfortable. Research & analyzation come hand-in-hand in successful trading.

Remember, the crypto market can be volatile. Prices can shift rapidly, & it’s essential to stay informed. Regularly follow market news & trends to enhance your trading strategy. Many beginners fall into the trap of fear & greed. Staying disciplined is key to long-term success.

Key Crypto Trading Strategies

Successful traders often employ specific strategies to enhance their chances of profit. Here are some key strategies beginner traders should explore:

- Day Trading: This strategy involves buying & selling cryptocurrencies within the same day. Traders aim to profit from small price changes.

- HODLing: Originally a misspelling of “hold,” this strategy suggests buying a coin & holding it for a long time. Investors believe in its future potential.

- Scalping: Scalping focuses on making small profits from many trades. Scalpers often make hundreds of trades each day, requiring quick decision-making.

- Swing Trading: This strategy involves holding cryptocurrencies for a few days or weeks. Traders aim to profit from predictable price swings.

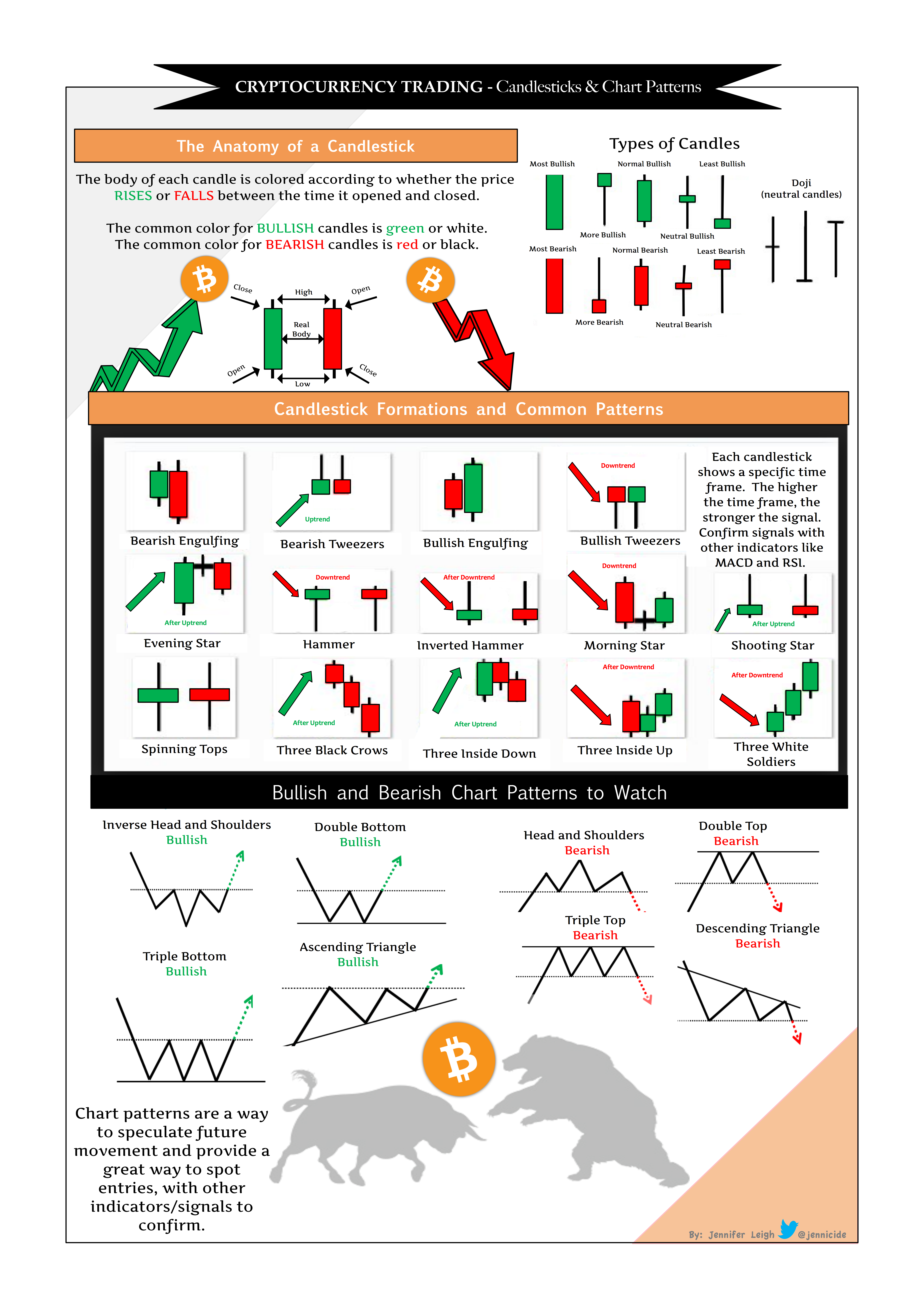

Alongside these strategies, it’s beneficial to use various technical analysis tools. Such tools can help identify trends & potential entry & exit points. Familiarize yourself with chart patterns & indicators. Understanding how to read charts effectively will aid in making informed trading decisions.

Risk management is also a critical component of any trading strategy. Investors should always set stop-loss orders to limit potential losses. This practice helps prevent significant financial setbacks. And another thing, it’s essential to maintain a balanced portfolio. Diversifying investments can spread risk across several assets.

Risk management plays a crucial role. A trader should never invest more than they can afford to lose. This way, you can safeguard your investments against unexpected market changes.

Common Mistakes to Avoid

Many new traders fall victim to various common mistakes. Being aware of these pitfalls can help you avoid them. Here are several mistakes to watch out for:

| Mistake | Description |

|---|---|

| Chasing Losses | Attempting to recover losses can lead to larger losses. |

| Overtrading | Engaging in too many trades can result in higher fees & losses. |

| Ignoring Research | Failing to conduct proper research can lead to uninformed decisions. |

| Emotional Trading | Letting emotions dictate trading decisions can impair judgment. |

Staying disciplined is vital for success. Avoiding emotional reactions can prevent dangerous trading decisions. Formulate a plan & stick to it. Monitor your trades & outcomes to learn from your experiences.

Another common error is neglecting to set clear goals. Establish both short-term & long-term goals. Having clear objectives will guide your trading strategy. Without goals, it’s easy to become lost & disinterested.

Utilizing Tools for Successful Trading

Many tools can improve your trading experience. Utilizing these tools will provide you with valuable insights. Consider exploring the following tools:

- Charting Software: Platforms that offer advanced charting features. This software helps visualize price movements & patterns.

- News Aggregators: Tools that compile news from various sources. Staying updated with relevant news can impact trading strategies.

- Price Alerts: Notifications about price changes. Setting alerts can help you act quickly on market movements.

- Portfolio Management Tools: Software that helps track your investments. Such tools offer insights into performance & growth.

For example, utilizing charting software helps identify potential buy or sell signals. This enhances your chances of success by aligning your trades with market movements. News aggregators provide insights on market trends & hacker news updates, ensuring you remain informed.

On top of that, portfolio management tools give you a holistic view of your investments. They help track the performance of all holdings in real-time. Regularly checking your portfolio will allow you to adjust strategies as needed.

Security Best Practices in Crypto Trading

Maintaining security should be a top priority for every crypto trader. Numerous security risks exist in this space. Here are some best practices for protecting your assets:

- Use Hardware Wallets: These wallets store your cryptocurrency offline, significantly reducing the risk of hacking.

- Enable Two-Factor Authentication: Adding an extra layer of security can protect your account from unauthorized access.

- Regular Updates: Ensure your software & wallets are updated frequently. Updates often address security vulnerabilities.

- Phishing Awareness: Be cautious of suspicious links & emails. Always verify the source before clicking.

Implementing these practices can significantly enhance your security. For instance, using a hardware wallet protects your assets from online threats. Security breaches often result in devastating losses, making precautionary measures essential. Bitcoin safety should always remain a priority.

And don’t forget, practice safe internet habits. Avoid public Wi-Fi when accessing your accounts. Use a VPN for added privacy. Keeping personal information secure is crucial for safeguarding your investments.

Analyzing the Market

Market analysis is essential for successful trading. Traders typically use two main types of analysis: fundamental analysis & technical analysis. Each method provides insights into price movements & coin potential.

Fundamental analysis evaluates a cryptocurrency’s value based on factors such as technology, team, & market demand. Understanding these elements can help identify coins with long-term growth potential. This analysis supports strategic buying & selling.

Technical analysis, on the other hand, involves examining past price charts & trading volumes. Traders often implement technical indicators like the Moving Average or Relative Strength Index (RSI) to assist their decisions. Learning to read charts is vital for predicting future movements.

| Technical Indicator | Description |

|---|---|

| Moving Average | Calculates the average price of a coin over a specific period. |

| Relative Strength Index (RSI) | Measures the speed & change of price movements to identify overbought or oversold conditions. |

Employing both methods can produce a more comprehensive understanding of the market. Make sure to analyze multiple factors in your trading plan. Remember that no strategy guarantees success. Continuous learning & adapting will improve your skills over time.

Staying Informed & Educated

Education is vital in crypto trading. Maintaining awareness of market trends & news is crucial. Many resources are available, including articles, podcasts, & online courses. Make it a habit to engage with relevant content.

- Follow credible news sources focusing on cryptocurrency news.

- Join online forums & communities for discussions.

- Participate in webinars or online workshops about trading strategies.

- Read books about financial principles & crypto trading.

Being proactive in your education will benefit your trading journey. The more you know, the better your decisions will be. Networking with experienced traders will also provide insights. Many platforms, like Reddit & Discord, offer spaces for discussion & advice.

“Knowledge is the key to thriving in crypto trading.” – Sarah Mitchell

Setting Realistic Expectations

Setting achievable goals is essential for sustaining motivation. Many beginners expect to become wealthy instantly, leadingto poor decisions. Crypto trading can produce substantial returns, but it also involves risks.

Understand that losses are part of the experience. Start with a clear plan that aligns with your financial situation. Create a strategy to measure success over time rather than focusing solely on short-term gains. Document your progress along with learnings. This approach will enhance growth & understanding.

Remember that developing successful trading skills takes time. Consistency & dedication provide long-term benefits. Seek to improve daily, rather than chase instant wealth. Adopting a patient & disciplined approach will yield more favorable outcomes.

<<<<< Buy Now from Official offer >>>>>

Feature of Fox Signals

Fox Signals provides users with valuable tools to enhance their crypto trading experience. One notable advantage is the Lifetime access to the product, enabling individuals to utilize the platform without any recurring fees. Users can redeem their codes within 60 days of purchase, ensuring that their investment remains engaging & accessible.

Another benefit includes All future Lifetime Plan updates. This commitment to continuous improvement allows users to stay updated with the latest features, ensuring a competitive edge in crypto trading.

It’s important to note that This deal is not stackable. Users should understand the terms to optimize their use of Fox Signals effectively. Below are some highlighted features:

- Lifetime access to trading signals.

- Regular updates & improvements.

- Access to a community of traders.

- Educational resources & tutorials.

- Customer support for troubleshooting.

Challenges of Fox Signals

While Fox Signals offers many benefits, users might encounter several challenges. For instance, the learning curve can be steep, especially for those new to crypto trading. Some features may not be intuitive, leading to frustration for inexperienced users.

Users have reported compatibility issues with certain trading platforms. Compatibility challenges can create delays in executing trades & accessing signals in real-time. These users recommend ensuring platform compatibility before committing fully to Fox Signals.

Feedback from users highlights these challenges, suggesting that enhanced onboarding materials could improve initial experiences. Tutorials, webinars, & detailed guides can help users acclimate to the system more efficiently.

Price of Fox Signals

Understanding the pricing structure of Fox Signals helps users gauge its value. The Lifetime Plan is offered at an attractive price:

| Plan Type | Price | Duration |

|---|---|---|

| Lifetime Plan | $69 | Forever |

This one-time fee provides long-term access to essential trading tools that can benefit crypto traders over time. Users can evaluate the cost against potential trading profits to justify this investment.

Limitations of Fox Signals

Despite its strengths, Fox Signals has certain limitations that may deter potential users. Firstly, missing features, such as advanced charting tools or algorithmic trading capabilities, could impair in-depth analysis, leaving some traders seeking more comprehensive solutions.

User experience can also be an area of concern. Some users find the interface not as user-friendly compared to other trading platforms. This might lead to a prolonged adaptation period & affect users’ trading efficiency.

Improvements are necessary in the analytics provided by Fox Signals, especially when compared to competitor products. Enhanced analytical tools could result in more informed trading decisions, increasing the overall appeal of the product.

Case Studies

Real-world examples show how Fox Signals has positively impacted users. One case study involves a trader named Mark, who faced initial struggles predicting market movements. After utilizing Fox Signals, Mark reported a significant increase in his trading success. The signals provided clarity & direction, allowing him to make timely trading decisions.

Another user, Sarah, shared her experience of navigating through volatile markets. She credited the timely alerts from Fox Signals for making swift trades that significantly reduced her losses during downturns. Sarah emphasized the importance of real-time information in her trading strategy.

These examples illustrate the practical benefits of using Fox Signals. Users have managed to overcome obstacles & improve their trading practices through effective use of the signals provided.

Recommendations for Fox Signals

To maximize the benefits of Fox Signals, users should consider a few strategies. First, regularly reviewing all signal updates can enhance reaction times during trades. Staying updated with new features & market trends aids in making informed decisions.

Pairing Fox Signals with fundamental analysis tools can deepen insights. Utilizing external resources, such as crypto news outlets, can provide valuable context that complements the signals.

Lastly, engaging in community discussions can be beneficial. Joining forums or social media groups where fellow users share experiences can offer additional learning opportunities. Sharing ideas & getting advice can lead to a more successful trading experience.

Effective Tools for Trading

- Crypto News Aggregators

- Technical Analysis Platforms

- Portfolio Management Tools

- Risk Management Software

- Trading Communities on Reddit

Key Strategies for Success

- Diversifying your portfolio.

- Setting clear trading goals.

- Regularly reviewing past trades.

- Utilizing stop-loss orders.

- Staying informed about market news.

Trading Tips to Improve Outcomes

- Start with small investments.

- Use demo accounts to practice.

- Understand technical indicators.

- Stay disciplined with trading plans.

- Keep emotions in check.

What is crypto trading?

Crypto trading involves buying & selling cryptocurrencies in order to profit from fluctuations in their prices. Traders can participate in various markets like exchanges for direct trading or over-the-counter for larger transactions.

How do I start trading cryptocurrencies?

To start trading cryptocurrencies, create an account on a reputable exchange, deposit funds, & choose a trading strategy. It’s essential to understand the market & have a clear plan before making trades.

What are some tips for beginner crypto traders?

Beginner traders should research & educate themselves about cryptocurrencies, diversify their portfolios, & set clear entry & exit points for trades. It’s also important to stay updated with market news & trends.

What are different types of trading strategies?

Common trading strategies include day trading, swing trading, scalping, & position trading. Each strategy has its own risk & time commitment, & traders should choose one that fits their style & goals.

What is a trading wallet?

A trading wallet is used to store cryptocurrencies securely. Depending on the trader’s needs, they can choose hot wallets for quick access or cold wallets for long-term storage of assets.

How do I read crypto charts?

Reading crypto charts involves analyzing price movements & patterns. Key elements include understanding candlestick patterns, volume indicators, & resistance/support levels to identify potential trade opportunities.

What are gas fees?

Gas fees are transaction fees paid to miners for processing transactions on a blockchain. These fees can vary based on network congestion & are an important factor in trading costs.

How can I secure my crypto assets?

To secure crypto assets, use strong passwords, enable two-factor authentication, & consider using hardware wallets for offline storage. Staying vigilant against phishing attempts is also crucial.

What are the risks associated with crypto trading?

Risks include market volatility, potential loss of funds, & regulatory changes. Beginners should assess their risk tolerance & consider using stop-loss orders to minimize losses.

What is a stop-loss order?

A stop-loss order is a tool that automatically sells a cryptocurrency when it reaches a certain price, helping traders limit losses on their investments.

How do taxes work for crypto trading?

Taxes on crypto trading vary by jurisdiction, but generally, profits from trading are subject to capital gains tax. Traders should keep thorough records of their transactions for tax reporting.

Where can I learn more about crypto trading?

There are various resources available for learning about crypto trading, including online courses, forums, & reputable financial news websites. Joining communities & following market experts can provide valuable insights.

<<<<< Buy Now from Official offer >>>>>

Conclusion

In wrapping up our Beginner’s Guide to Crypto Trading, remember that starting small can lead to big things! Embrace the tips & strategies we’ve shared, & always keep learning. Stay patient, as crypto trading can be a rollercoaster ride. It’s important to stick to your best practices & never invest more than you can afford to lose. Join communities to share your journey, as support can be invaluable. With the right mindset & preparation, you can navigate the exciting world of crypto trading confidently & effectively. Happy trading!

<<<<< Buy Now from Official offer >>>>>