Top Investment Opportunities in Cryptocurrency for Smart Investors. Discover the top investment opportunities in cryptocurrency for smart investors. Uncover exciting ways to grow your wealth & join the future today!

<<<<< Buy Now from Official offer >>>>>

Understanding Cryptocurrency Basics

To identify the best investment opportunities, you should know key concepts behind cryptocurrency. Cryptocurrencies are digital assets that use cryptography for security. They operate on technology called blockchain. A blockchain is a decentralized ledger where all transactions are recorded. It ensures transparency & security.

Bitcoin is the first cryptocurrency, created in 2009. Since then, thousands of alternatives, known as altcoins, have emerged. Each coin has unique features & purposes. Some focus on fast transactions, while others provide privacy. Therefore, research each coin’s purpose before investing.

Investing in cryptocurrencies can be rewarding. Be that as it may, volatility is an inherent risk. Prices can soar or plummet within hours. For instance, in 2021, Bitcoin reached an all-time high of nearly $65,000. In 2022, it dropped under $30,000. Understanding these fluctuations is vital for smart investing.

Careful planning is essential. Always set a budget for your investments. Decide how much you can afford to lose. Avoid putting all your money into one coin. Diversifying your portfolio reduces risk. You can invest in multiple assets to spread your risk.

Also, stay informed about market trends. Follow cryptocurrency news & updates. Join online forums or social media groups. They can provide valuable insights. Being part of a community helps you make sound investment choices.

Top Cryptocurrencies to Watch

Many cryptocurrencies present promising investment opportunities. Be that as it may, some stand out more than others. Here’s a brief look at top contenders:

| Cryptocurrency | Market Cap (Approx.) |

|---|---|

| Bitcoin (BTC) | $800 billion |

| Ethereum (ETH) | $200 billion |

| Binance Coin (BNB) | $40 billion |

| Cardano (ADA) | $15 billion |

| Solana (SOL) | $10 billion |

Bitcoin remains the largest & most recognized cryptocurrency. Its scarcity & growing acceptance drive investment opportunities. Ethereum, on the other hand, is popular for its smart contracts. Investors see potential in projects built on its platform.

Other alternatives like Binance Coin & Cardano are gaining attention. They offer scalability & lower transaction fees. Solana is known for its speed & efficiency. Investors appreciate these features, making them worthwhile candidates.

Keeping an eye on new trends is essential. New projects emerge frequently. Always do thorough research. Look into whitepapers, project goals, & use cases before investing.

Long-Term vs. Short-Term Investment Strategies

Investors often choose between long & short-term strategies. Each method has its advantages & disadvantages. Knowing these can help you make better decisions.

Long-term investing, also known as HODLing, involves holding assets for years. This strategy benefits from market growth over time. Investors believe that solid projects will appreciate in value. It typically comes with less stress. You can ride out market fluctuations without daily scrutiny.

- Less time-consuming

- Focus on strong projects

- Potential for significant returns

On the other hand, short-term investment strategies often involve frequent trading. Traders look to capitalize on small price movements. This can be highly rewarding but also risky. It requires constant monitoring of market trends. Traders need to be prepared for volatility.

- Requires active management

- Potential for quick profits

- Higher risk of losses

Your choice depends on your risk tolerance & time commitment. Some investors prefer a mix of both strategies. A balanced portfolio can provide stability & growth.

Identifying Promising Projects

When investing in cryptocurrency, knowing how to find promising projects is crucial. Here are essential factors to consider:

- Team background & experience

- Technology & innovation

- Community support & engagement

- Partnerships & collaborations

The team behind a project plays a vital role. Experienced & reputable developers often lead successful initiatives. Investigate their background & previous projects. A strong record boosts investor confidence.

Technological innovation is another factor. Look for projects with unique use cases or solutions to real-world problems. For example, some cryptocurrencies focus on enhancing security, while others improve transaction speed. Projects addressing significant market gaps tend to perform better.

Community support is also crucial. Engaged communities can drive a project’s growth. Active users promote the coin & raise awareness. Verify the community’s size through social media platforms. Positive sentiment indicates potential success.

Lastly, partnerships matter. Collaborations with established companies can validate a project’s credibility. They can enhance visibility & adoption. An extensive partner network can lead to more investment opportunities.

Utilizing Cryptocurrency Exchanges

Cryptocurrency exchanges are platforms allowing you to buy or sell digital currencies. Choosing reputable exchanges is vital for your investment journey. Here are notable exchanges:

| Exchange | Features |

|---|---|

| Coinbase | User-friendly interface, strong security |

| Binance | Wide range of cryptocurrencies, low fees |

| Kraken | Advanced trading tools, high liquidity |

| Gemini | Regulated, strong security measures |

Each exchange has unique features & benefits. Coinbase is popular among beginners due to its user-friendly interface. Binance offers a wide variety of cryptocurrencies & low trading fees. Kraken caters to more experienced investors with advanced tools.

When selecting an exchange, prioritize security. Look for two-factor authentication & cold storage options. These measures protect your funds from hackers. And another thing, checking customer reviews can provide insights into an exchange’s reliability.

Once you choose an exchange, creating a wallet is essential. A wallet allows you to store your cryptocurrencies securely. Different types of wallets include:

- Hardware wallets

- Software wallets

- Paper wallets

Each wallet type has its pros & cons. Hardware wallets are highly secure, while software wallets provide convenience. Paper wallets are a low-tech option. Decide based on your needs & risk tolerance.

Risks & Challenges in Cryptocurrency Investment

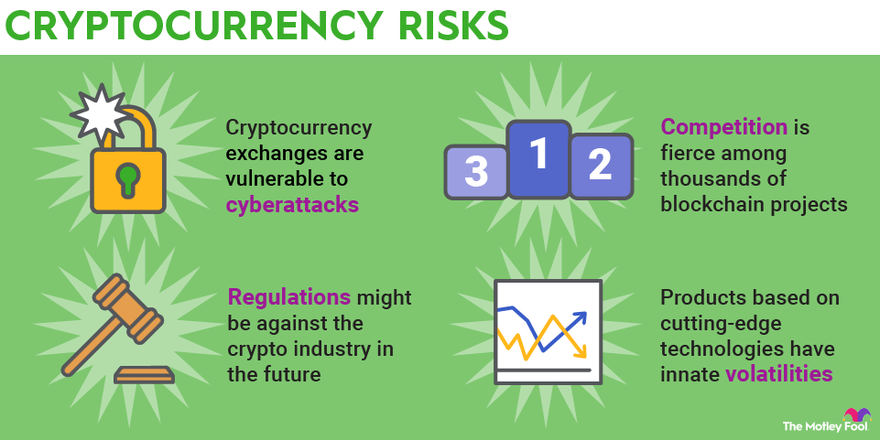

Investing in cryptocurrency is not without risks. Awareness of potential challenges is vital for smart investing. One of the biggest risks is market volatility. Prices can change quickly, leading to significant gains or losses.

Another challenge is regulatory uncertainty. Governments worldwide are still figuring out how to regulate cryptocurrencies. New regulations can impact market conditions. Changes may create sudden price swings. Investors need to stay informed about regulations in their respective countries.

Security threats also exist. Cyberattacks have targeted exchanges, leading to substantial losses. Always choose secure exchanges & wallets. Implement safety measures to protect your assets.

The lack of consumer protection is another risk. Unlike traditional financial markets, cryptocurrencies offer limited recourse. If an exchange fails or your funds get stolen, recovery can be challenging.

Finally, scams & fraud are prevalent in the cryptocurrency sector. Always verify information before investing. Look for red flags such as unrealistic returns or high-pressure tactics. Forums & reviews are great ways to research projects.

Strategies for Staying Informed

To navigate cryptocurrency investing successfully, staying informed is crucial. Following news & trends can shape your investment decisions. Here are effective strategies to remain updated:

- Subscribe to cryptocurrency newsletters

- Follow influential figures on social media

- Join online forums & groups

- Listen to podcasts about cryptocurrency

Newsletters can provide insights straight to your inbox. Choose reputable sources for reliable information. Popular options include CoinDesk & CoinTelegraph. Their articles cover market analyses & emerging trends.

Social media platforms like Twitter can be valuable resources. Many industry experts share insights on these platforms. Following thought leaders keeps you informed about developments & predictions.

Participating in online forums or groups offers additional support. You can engage with fellow investors & share experiences. Platforms like Reddit host active cryptocurrency communities. They discuss news, trends, & investment strategies.

Podcasts can also enhance your cryptocurrency knowledge. Many channels focus on market trends & expert opinions. Listening during your commute or while exercising is easy & beneficial.

My Personal Experience with Cryptocurrency Investments

In my experience as an investor, I found cryptocurrency fascinating. I started with Bitcoin & quickly learned about volatility. Early on, I faced ups & downs but remained determined. I researched extensively & diversified my portfolio. This approach allowed me to discover new opportunities & make educated decisions.

I focused on finding reliable projects & engaging with communities. This interaction led to valuable insights about upcoming trends. It was a learning curve, but persistence paid off. Over time, my portfolio expanded significantly.

Future Trends in Cryptocurrency Investment

As the cryptocurrency market matures, emerging trends are noteworthy. Understanding these trends can position you for success. Here are several developments to watch for:

- Increased institutional investment

- Integration of blockchain in various industries

- Decentralized finance (DeFi) growth

- NFTs & their evolving applications

Institutional investment in cryptocurrencies is on the rise. Major companies are beginning to allocate resources to crypto assets. This trend can lead to increased price stability & legitimacy for the market.

And don’t forget, blockchain technology is penetrating multiple industries. From supply chain management to healthcare, innovative applications are emerging. These developments can enhance credibility & raise awareness.

Decentralized finance (DeFi) is also gaining traction. DeFi projects aim to recreate traditional financial systems using blockchain. These solutions offer users more control over their assets. Investors should monitor promising DeFi projects.

NFTs continue to evolve, too. Initially focused on digital art, they are finding broader use cases. Industries like gaming & music are exploring NFT applications. Investing in promising NFT projects may prove lucrative.

Quote from a Cryptocurrency Expert

“Investing in cryptocurrency requires discipline & knowledge. Always do your homework before diving in.” – Sarah Johnson

<<<<< Buy Now from Official offer >>>>>

:max_bytes(150000):strip_icc()/Primary_Images-421ad583334747108aab43b54152822f.jpg)

Feature of Fox Signals

Fox Signals offers a variety of features aimed at enhancing user experience. First & foremost, purchasers enjoy lifetime access to this valuable tool. This means users can utilize all the functionalities without worrying about subscription renewals or excessive costs. It’s a one-time investment that pays off in the long run.

And another thing, users must redeem their codes within 60 days post-purchase. This ensures that all clients remain engaged, actively utilizing the product soon after acquisition. And don’t forget, all future lifetime plan updates are included at no additional cost. Subscribers will benefit continuously from updates, new features, & improvements as they become available.

It’s important to note that this deal is not stackable. Users can take advantage of the offer with confidence, knowing there are no hidden conditions affecting their purchase. Such clarity empowers smart investors to make informed decisions when it comes to their crypto strategies.

Challenges of Fox Signals

Despite its advantages, users face several challenges while using Fox Signals. One prominent issue reported by users involves the limitations in features compared to other alternatives. While it offers great insights, some find it lacks depth in certain areas. Customer feedback often mentions that the software could provide more customizable reporting options to cater to diverse trading strategies.

Another challenge comes in the form of compatibility issues. Users on different devices experience varying performance levels, which can limit access for some. This inconsistency can be frustrating, especially for those looking to analyze or make decisions on the go. Compatibility testing across multiple platforms could significantly enhance the user experience.

Potential learning curves represent an additional hurdle. New users often find it difficult to utilize Fox Signals fully without prior experience. Some users suggest offering adequate training resources or an onboarding process to ease this transition. Providing detailed tutorials & customer support may help newcomers become familiar with functionalities more quickly.

Price of Fox Signals

The pricing structure for Fox Signals is straightforward & cost-effective. The Lifetime Plan is available for just $69. This one-time fee grants users lifelong access to the product, making it a wise choice for those looking to invest in cryptocurrency effectively.

| Plan Type | Price | Access Duration |

|---|---|---|

| Lifetime Plan | $69 | Lifetime Access |

Limitations Fox Signals

Fox Signals presents several limitations that might influence potential buyers. One significant drawback is the interface’s complexity. Many users find it less intuitive than competing platforms. Simplifying the user interface could enhance usability & attract more users.

Another limitation focuses on the absence of advanced analytic tools. In comparison to other similar products, certain features, such as enhanced charting capabilities & predictive analytics, are either absent or underdeveloped. This can hinder the depth of analysis that investors can perform, potentially affecting their trading decisions.

On top of that, some users express concerns about the customer support response time. When users encounter issues, they expect prompt assistance. Addressing support infrastructure may help in building trust & credibility with the customer base.

Case Studies

Real-life case studies illustrate how Fox Signals can enhance crypto investments. One user reported successfully utilizing the platform to track emerging cryptocurrencies, leading to a 30% return within three months. This experience emphasizes the potential profitability of informed decision-making through Fox Signals.

Another case study involved a group of traders who combined Fox Signals with their analysis. They highlighted how the product’s updates provided critical data points that confirmed their trading hypotheses. By synchronizing it with their methods, they achieved a collective profit margin of 25% over a quarter.

A third case involved a new investor who initially struggled to understand the platform. By dedicating time to the tutorials & troubleshooting resources, the individual overcame the learning curve. Within six months, they reported achieving personal investment goals, showcasing how persistence & proper resource utilization can lead to success.

Recommendations for Fox Signals

Maximizing the benefits from Fox Signals involves several strategies. First, users should actively engage with training materials available. Taking the time to familiarize oneself with all features will go a long way in enhancing unit utilization. This proactive approach can result in better investment decisions.

Incorporating additional tools can augment the functionalities of Fox Signals. Utilizing complementary software for detailed analytics could provide deeper insights. An example might include integrating with spreadsheet software to manage trading data more effectively.

Networking with other users is another recommendation. Joining online communities dedicated to Fox Signals can offer an avenue to share strategies, tips, & insights. Learning from the experiences of others may lead to uncovering unique strategies that could boost investment opportunities.

Investment Opportunities in Cryptocurrency

At this point, let’s discuss various promising investment opportunities in cryptocurrency. Given the current trends & technological advancements, smart investors can identify optimal areas for investment.

- Decentralized Finance (DeFi)

- Non-Fungible Tokens (NFTs)

- Layer 2 Solutions

- Smart Contracts

- Cross-Chain Platforms

Emerging Cryptocurrencies to Watch

Investing in emerging cryptocurrencies represents a compelling opportunity. Many of these coins have promising prospects based on recent market activities. Here are a few noteworthy mentions:

- Solana (SOL)

- Polkadot (DOT)

- Cardano (ADA)

- Chainlink (LINK)

- Avalanche (AVAX)

Top Tools for Cryptocurrency Trading

Using the right tools can significantly affect trading success. Here are some essential tools that traders should consider:

- Binance

- Coinbase

- BlockFi

- TradingView

- Reddit Cryptocurrency Communities

Tips for Staying Updated in Cryptocurrency

In the fast-paced world of cryptocurrency, staying informed is essential. Here are some effective tips for remaining updated:

- Follow reputable news outlets

- Subscribe to expert newsletters

- Join cryptocurrency forums

- Use social media responsibly

- Attend virtual conferences

Conclusion on Cryptocurrency Opportunities

Smart investors continually assess opportunities in cryptocurrency. By focusing on tools like Fox Signals & recognizing emerging trends, they can maximize potential returns.

What are the top investment opportunities in cryptocurrency today?

Some of the top investment opportunities in cryptocurrency include Bitcoin, Ethereum, decentralized finance (DeFi) projects, & non-fungible tokens (NFTs). Smart investors often look at established coins as well as promising new projects in the market.

How can smart investors assess cryptocurrency opportunities?

Smart investors can assess cryptocurrency opportunities by researching project fundamentals, evaluating team backgrounds, analyzing market trends, & considering community support. It’s also crucial to stay updated with regulatory news & technological advancements.

Is it better to invest in established cryptocurrencies or new altcoins?

The decision to invest in established cryptocurrencies versus new altcoins depends on individual risk tolerance. Established cryptocurrencies tend to be more stable, while new altcoins may offer higher reward potential but come with increased risk.

What role does blockchain technology play in cryptocurrency investments?

Blockchain technology is foundational for cryptocurrency investments as it provides transparency, security, & decentralization. Understanding how different blockchains operate can help investors make informed choices.

How important is market capitalization in evaluating a cryptocurrency?

Market capitalization is important in evaluating a cryptocurrency as it gives an idea of the coin’s size & adoption. Higher market caps generally indicate stability, while lower market caps may present higher risks along with potential rewards.

What are DeFi projects & why are they appealing to investors?

DeFi projects provide decentralized financial services such as lending, borrowing, & trading without intermediaries. They appeal to investors because of their potential for high returns & the ability to earn passive income through yield farming & staking.

What risks should investors consider in cryptocurrency investments?

Investors should consider risks such as market volatility, regulatory changes, technological issues, & security threats. Understanding these risks can help investors develop strategies to mitigate them.

Can investing in cryptocurrency provide diversification benefits?

Yes, investing in cryptocurrency can provide diversification benefits as it typically behaves differently than traditional asset classes like stocks or bonds. Including cryptocurrencies in a portfolio may enhance overall returns while reducing risk.

What is the significance of NFTs in the current investment landscape?

NFTs have gained popularity as unique digital assets & collectibles. Their significance lies in the potential for ownership, scarcity, & the ability to monetize digital artwork & content, attracting a diverse group of investors.

How does one securely store their cryptocurrency investments?

Secure storage of cryptocurrency investments can be achieved through hardware wallets, software wallets, or cold storage solutions. Using two-factor authentication & maintaining backups are also recommended practices for security.

What factors influence the price of cryptocurrencies?

Several factors influence the price of cryptocurrencies, including supply & demand dynamics, market sentiment, regulatory developments, & technological advancements. Keeping an eye on these factors can aid in making informed investment decisions.

<<<<< Buy Now from Official offer >>>>>

Conclusion

Investing in cryptocurrency can be exciting & profitable for smart investors. With various opportunities like Bitcoin, Ethereum, & DeFi projects, there’s something for everyone. It’s essential to do your research & stay updated on market trends. Don’t forget to look into altcoins & NFTs as they hold potential too! Remember, investing is not just about quick gains but also about understanding what can grow over time. So, take your time, learn the ropes, & enjoy the journey in this vibrant world of cryptocurrency. Happy investing!

<<<<< Buy Now from Official offer >>>>>